When you’re considering a home loan (or a Reverse Mortgage), understanding the mortgage interest rates is crucial.

The interest rate determines how much extra money borrowers must pay on top of the borrowed amount. A lower rate means less money paid in interest, while a higher rate increases the overall cost of releasing home equity.

For each 1% increase in interest rate, the monthly interest cost increases and the total payable over the years can rise by thousands of dollars.

The same applies when interest rates are falling. For each 1% decrease in interest rate, the monthly interest cost decreases and the total payable over the years can drop by thousands of dollars.

This demonstrates why it’s important for Reverse Mortgage borrowers to:

- Understand where we are in the interest rate cycle at any given time

- Secure the lowest possible rate and

- Understand the terms of any mortgage offer (even small differences in the interest rate can have large financial implications over time).

These are all things a specialist Reverse Mortgage broker like Seniors First can help with.

Factors Influencing Mortgage Interest Rates

The Reserve Bank of Australia (RBA) sets the official cash rate, which is the interest rate on overnight loans between banks. This rate significantly influences the interest rates that banks charge on mortgages.

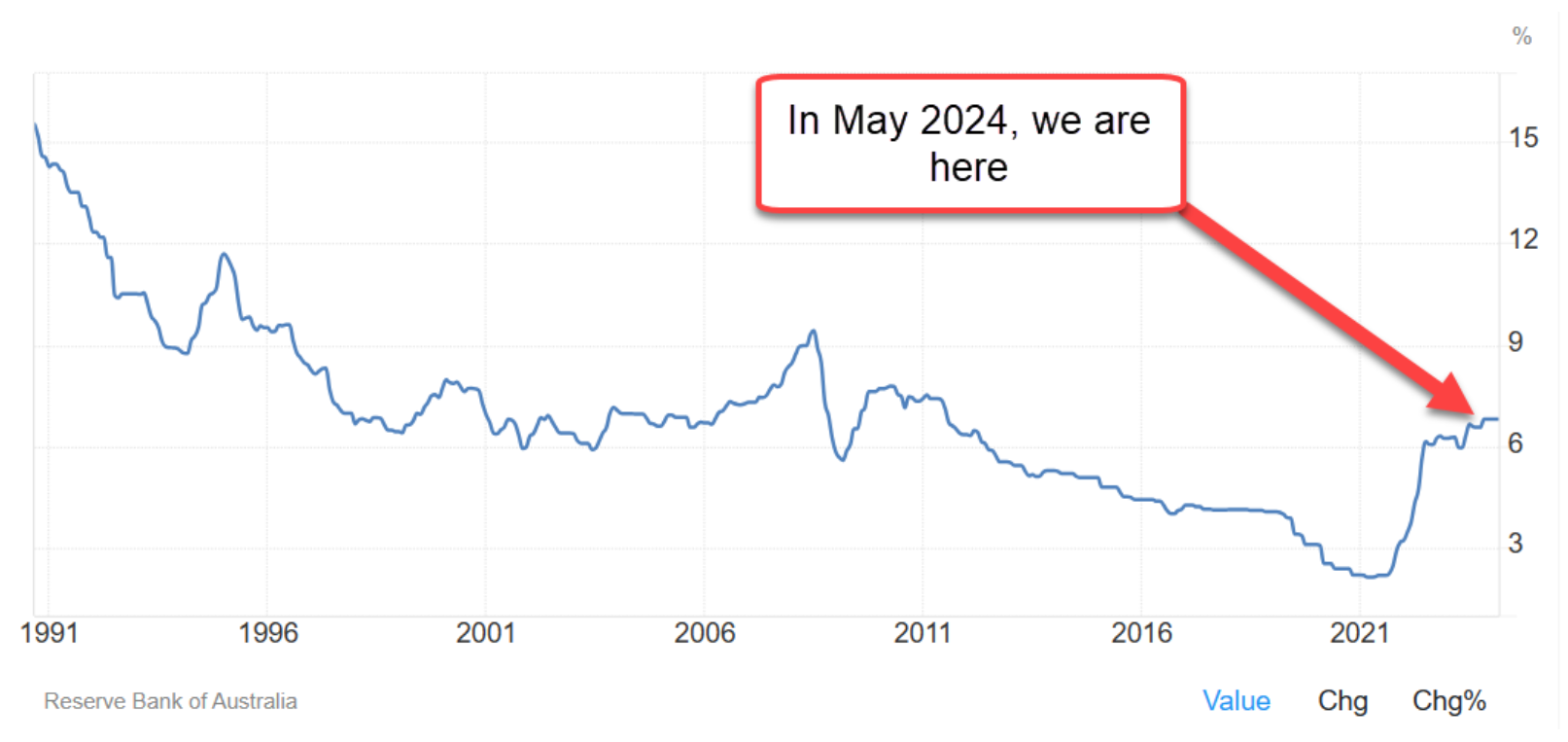

Historically, mortgage interest rates in Australia have shown a dynamic pattern, fluctuating significantly over the decades. Since 1990, mortgage rates have averaged around 6.86%, with peaks and troughs driven by various economic conditions.

For instance, in September 1990, rates hit an all-time high of 15.50% during an economic downturn, contrasting sharply with a record low of 2.14% in March 2021, spurred by government and central bank initiatives to bolster the economy during the COVID-19 pandemic.

Long-term History of Interest rates in Australia

These fluctuations illustrate that while rates may currently seem high, they are relatively moderate compared to historical extremes. This dynamic nature of interest rates reflects the Reserve Bank of Australia’s adjustments in response to economic shifts, aimed at stabilising the economy.

For potential borrowers, this history underscores the importance of viewing current rates within a broader historical context, recognizing that rates have always been subject to change and will continue to adapt to future economic conditions.

FACT: the long-term average cash rate in Australia is 7.43%. The current rate is just 4.35%.

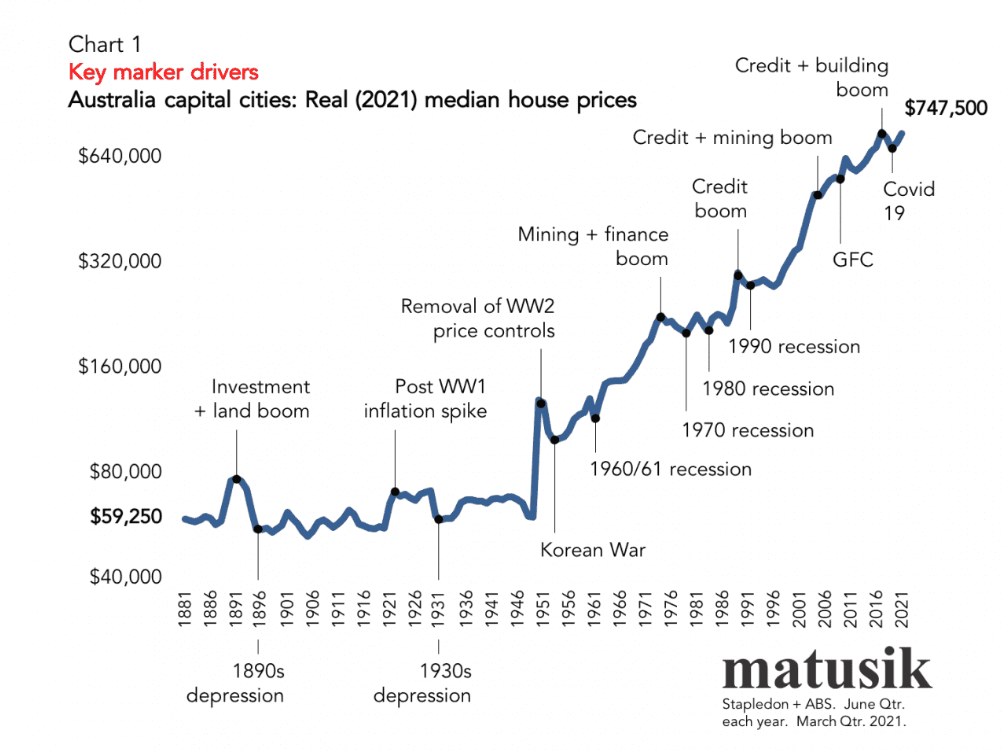

What About House Prices?

While it’s important to think about interest rates when considering a Reverse Mortgage loan, we should also look at how much home values have gone up over the years. This increase in home prices can be a big help to homeowners, including seniors considering a Reverse Mortgage.

Steady Increase in Home Prices

For many years, homes in Australia have been increasing in value. This isn’t just in big cities but also in smaller towns. Homes have generally become more valuable over time.

For seniors, this rise in home prices means that the value of what you own in your home (your equity) has grown. Equity is the part of your home that you really own—what’s left after subtracting any loan balance from the market value of your home.

As the value of your home goes up, so does your equity. This can be a good thing because it means you have more financial security, even if interest rates go up.

Making the Most of Your Home’s Increased Value

With the value of your home going up, you have more options. This can help you feel more secure about money in retirement, pay for healthcare, or clear other debts. It’s comforting to know that the growth in your home’s value can help balance out the costs of a Reverse Mortgage.

Future Expectations: Predicted Movements in Interest Rates

Looking ahead at the movements in interest rates, the Commonwealth Bank (CBA) has recently adjusted its forecasts, indicating potential changes that could influence your mortgage decisions. Understanding these predictions and the broader economic indicators can help you better prepare for what’s coming.

CBA’s Interest Rate Forecast

CBA predicts a rate cut later this year, expecting the Reserve Bank of Australia (RBA) to lower the cash rate to 4.1% from 4.35%. This shift is a revision from their earlier prediction of more substantial cuts in 2024. The adjustment comes in light of recent economic data and inflation trends, suggesting a more cautious approach to rate reductions.

Economic Indicators Influencing RBA Decisions

Recent retail sales data has shown a decline, which might influence the RBA’s approach towards interest rates. A drop in retail sales suggests softer consumer spending, often a sign of broader economic cooling. This cooling could justify a cut in interest rates to stimulate spending and economic activity.

Impact on Borrowers

For potential borrowers, this forecast means that while current rates might seem high, there is potential relief on the horizon with expected rate cuts. It’s important to stay informed about these forecasts as they directly impact mortgage rates and, consequently, your repayment amounts.

For those of you worried about high rates, the message here is to keep a close eye on economic reports and RBA announcements.

Changes in the economic landscape, like those suggested by recent retail data, are pivotal in shaping the RBA’s decisions, which in turn affect your mortgage costs.

Consulting with a financial adviser to discuss these trends and your personal circumstances can also provide tailored advice that helps you navigate through these changes.

Stay updated, plan accordingly, and remember, interest rates are always dynamic—they go up, but they also come down.

Reverse Mortgage Interest Rates

Understanding the interest rates and costs associated with Reverse Mortgages is crucial for anyone considering this financial option. Here’s a breakdown of the key points about Reverse Mortgage interest rates and how they work:

- Variable Rates: Currently, Reverse Mortgages typically offer only variable interest rates. These rates are calculated daily based on the prevailing market rate and are charged monthly in arrears. This means that each month’s interest is added to the loan balance, increasing the total amount owed over time unless voluntary payments are made.

- Rate Flexibility: Variable rates on Reverse Mortgages can offer some flexibility. For instance, you might not be charged for making additional repayments, which can help reduce the loan balance faster than scheduled. Some plans may also include features like offset accounts or redraw facilities, adding to the flexibility in managing the loan.

- Higher Rates Compared to Traditional Home Loans: Reverse Mortgage rates are generally higher than those for standard home loans, often by one or two percentage points. This higher rate compensates lenders for the increased risk associated with not receiving any repayment of the principal for potentially many years.

- Compounding Interest: The compounding nature of interest on Reverse Mortgage means that interest is charged not only on the initial drawn loan amount, but also on the accumulated interest from previous months. This can significantly increase the loan balance over time.

Tips to Minimise Reverse Mortgage Interest

Minimising the interest costs on a Reverse Mortgage can significantly affect the overall financial health of borrowers, particularly seniors who are looking to manage their assets and retirement savings effectively.

Here are some strategies to consider:

1. Make Partial Repayments

If your reverse mortgage terms allow, making occasional or regular repayments can help reduce the principal balance and thus, the interest accrued over time.

2. Choose a regular advance plan

Opt for a payment plan that suits your financial situation. For instance, drawing a tiny amount of funds each month rather than taking a lump sum upfront can lower the amount of interest that accumulates.

3. Stay Informed About Rate Changes

Keep an eye on interest rate trends. If rates drop, consider renegotiating your mortgage terms or refinancing to secure a lower rate.

4. Use Features Wisely

If your reverse mortgage includes features like a line of credit or cash reserve, use these to reduce the interest charges. Available credit held in these accounts don’t attract interest charge until funds are drawn, in part of in full.

5. Regularly Review Your Loan

Periodic reviews of your mortgage agreement with a financial advisor can ensure that your reverse mortgage remains aligned with your financial goals and adjusts to any changes in your financial situation.

By implementing these strategies, reverse mortgage borrowers can manage and potentially reduce the impact of interest costs, preserving more of their home equity over the long term.

CONCLUSION

- Current interest rates sit at a moderate level, aligning with the long-term average and reflecting typical historical trends.

- Most financial experts believe that we are currently at or near the peak of the current interest rate cycle.

- A significant number of analysts forecast a decline in rates sometime in 2024.

- Reverse mortgage borrowers have access to a variety of tactics to minimise their interest costs effectively.

Want to learn more about Reverse Mortgage? Find out more about how to use a Reverse Mortgage for debt consolidation or download your FREE REVERSE MORTGAGE GUIDE.

Ready to Apply? You can now check your eligibility online or call Seniors First on 1300 745 745.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.

Interesting that the banks did not hesitate when people were within their demographic.

Now they have jettisoned the people who made their profits before.

Stay away from them and advertise their bias and lack of service as much as you can.