Imagine working your whole life, saving every penny, only to have it swindled away by a scammer. For many seniors, this isn’t just a fear; it’s a reality. Scams can drain life savings, leaving victims struggling to cover everyday expenses or medical bills.

With the Australian Bureau of Statistics reporting a gross amount of $2.2 billion withdrawn or used in card fraud incidents in one financial year alone, the scale of the issue is immense.

Beyond the financial loss, the emotional aftermath of being scammed is profound. Victims often experience shame, embarrassment, and a sense of betrayal. Trust, a fundamental human need, is shattered.

This emotional distress can lead to isolation, depression, and a decreased sense of self-worth, particularly detrimental to seniors who may already be facing challenges related to ageing and loneliness.

Moreover, it’s crucial to recognize that scams targeting seniors often intersect with broader issues of elder abuse—a significant concern in Australia.

Elder abuse can manifest in various forms, including financial, physical, psychological, and sexual abuse, as well as neglect.

The Australian Institute of Family Studies reports that approximately 15% of Australians aged 65 and over living in community settings have experienced some form of elder abuse. This reality underscores the importance of vigilance and support to protect our elderly population from such exploitation.

[ RELATED POST: Money, Memory, and Mortgages: Exploring Wealth Transfer in Australia’s Dementia Crisis ]

Top Scams Currently Targeting Australian Seniors

Awareness is your best defence against scams. By understanding the types of scams prevalent in Australia, you can better protect yourself and your loved ones from these deceptive tactics.

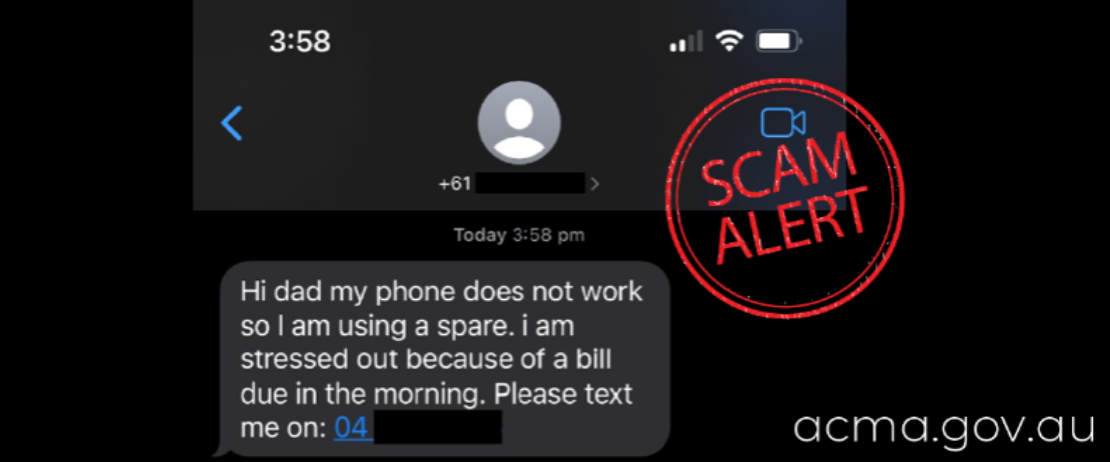

The ‘Hi Mum’ Scam

This scam involves a message from an unknown number, claiming to be a family member who has lost their phone. The scammer builds rapport before asking for money or personal information. Always verify the identity of the person through independent means before taking any action.

Phone Scams

Telemarketing scams are widespread, with fraudsters posing as government officials, bank representatives, or even family members in distress. Remember, legitimate organisations will never pressure you to provide personal information over the phone.

Internet Fraud

The digital realm is a playground for scammers. From phishing emails that mimic legitimate institutions to fake websites designed to steal your personal information, the internet is rife with dangers. Be wary of emails or messages that ask for your personal details or prompt you to click on suspicious links.

Door-to-Door Scams

While perhaps more traditional, these scams are still prevalent and can be quite convincing. Scammers may come to your door, pretending to represent charities, utility companies, or even governmental agencies, seeking donations or personal information. A good rule of thumb is to never share personal information with someone who unexpectedly shows up at your door.

Buying and Selling Scams

Whether you’re shopping online or selling items, be cautious of fraudulent buyers and sellers. These scams can take many forms, from fake listings on e-commerce platforms to fraudulent payment requests for items you’re selling. If a deal seems too good to be true, it probably is.

Elder Abuse

Interestingly, the perpetrators of elder abuse are often close to the victims, with family members, particularly children, being significant perpetrators. This fact underscores the sad reality that elder abuse can occur within trusted relationships, highlighting the complexity and sensitivity required in addressing and preventing these incidents.

By staying informed about these scams and adopting a cautious approach to any unsolicited communications or offers, you can protect your financial and personal well-being.

Recognising the Signs of a Scam

Here are some tell-tale signs that the communication you’re receiving—whether it’s via phone, email, or in person—might be a scam:

- Unexpected Contact: If you receive a call, email, or visit from someone claiming to be from a company, government agency, or charity without prior contact, be cautious. Genuine organisations usually don’t reach out without a reason.

- Requests for Personal Information: Be wary of unsolicited requests for your personal or financial details. Legitimate entities will not ask for sensitive information like your bank details, PINs, or passwords in an unsolicited communication.

- Pressure Tactics: Scammers often create a sense of urgency to prompt a quick response. They might claim you need to act immediately to claim a prize, avoid a fine, or help a loved one in distress.

- Too Good to Be True Offers: If an offer seems incredibly favourable without any apparent catch, it might be a scam. Be sceptical of unexpected prize notifications, investment opportunities with guaranteed returns, or requests to transfer money to claim a prize.

- Poor Grammar and Spelling: Communications from professional organisations are usually well-written. Misleading emails or messages often contain spelling and grammatical errors.

- Unusual Payment Methods: Scammers might ask for payment via unconventional methods like gift cards, wire transfers, or cryptocurrencies. Reputable organisations will allow you to use secure, traceable payment methods.

How to Report Suspicious Activities

If you believe you’ve encountered a scam, report it to the Australian Competition and Consumer Commission (ACCC) via the Scamwatch website. This helps them track scam trends and warn others.

Meanwhile, if the scam involves your financial information or accounts, notify your bank or financial service provider immediately. They can help secure your accounts and monitor for any unusual activity.

If the scam occurred online, consider reporting it to the platform where it happened (e.g., a social media platform, online marketplace, or email provider) so they can take action against the scammer.

Also don’t forget to document all communications with the scammer, including emails, phone numbers, or online messages. This information can be crucial for investigations.

Remember, your actions can make a difference.

By reporting scams, you contribute to a broader effort to combat fraud and protect the community, particularly vulnerable groups like seniors.

Is Reverse Mortgage a Scam?

Let’s debunk this myth: Reverse Mortgages are NOT a scam. They are legitimate financial products, heavily regulated by the Australian Securities and Investments Commission (ASIC). These regulations are designed to safeguard borrowers, ensuring that you, as a senior Australian, can leverage the equity in your home securely and effectively.

Borrowers’ Protections Under ASIC Regulations

The No Negative Equity Guarantee is a key feature of these protections. It ensures that you’ll never owe more than the value of your home when the loan is due for repayment. This is a crucial safeguard that secures your financial wellbeing and the value of your estate.

[ RELATED POST: Five Reverse Mortgage Myths Debunked ]

How Does a Reverse Mortgage Work?

- Equity Unlock: The amount you can borrow depends on factors like your age and your property’s value. Different lenders have their policies, but the essence remains: you get to unlock the equity in your home, providing you with financial flexibility in your retirement years.

- Ownership and Residence: Borrowing against your home doesn’t mean you lose ownership. You retain full ownership and the right to live in your home for as long as you choose.

- Repayment Terms: There’s no immediate need to repay the loan. Interest accrues and is added to the loan balance over time. However, you can make voluntary repayments to manage the loan’s growth.

- Settlement of the Loan: The loan is typically settled once the borrower passes away, moves into aged care, or decides to sell the property. The settlement includes the loan amount plus any interest and fees.

While Reverse Mortgages can provide financial relief and more freedom in retirement, they’re not a one-size-fits-all solution. It’s crucial to understand the specifics of the loan, how it fits into your financial plan, and the long-term implications for you and your estate.

Contact Seniors First for more information about Reverse Mortgages or call us on 1300 745 745.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.

It is disappointing that reverse mortgage availability is postcode sensitive with rural locations being ineligible