Recent banking reforms, initially aimed at curbing predatory lending, have inadvertently tightened credit access for many Australian seniors, leaving them struggling to navigate a rapidly digitising economy.

According to Chris Grice, CEO of National Seniors in an interview with ABC, this shift has resulted in a challenging “whack-a-mole” scenario where solving one issue often gives rise to another.

As these changes unfold, many Australian seniors find themselves without a credit rating and deemed “high risk,” making essential services such as car hire and hotel bookings unattainable.

With credit cards becoming harder to secure, especially in their post-retirement years, seniors are missing out on the conveniences of modern economic life—imagine needing to book a flight online to visit your grandchildren or secure a hotel room for a special family event, only to find your payment options limited.

This growing gap, highlighted in the ABC report, underscores a pressing need for solutions that accommodate the unique financial needs of older Australians.

The Growing Digital Divide and Its Effects on Seniors

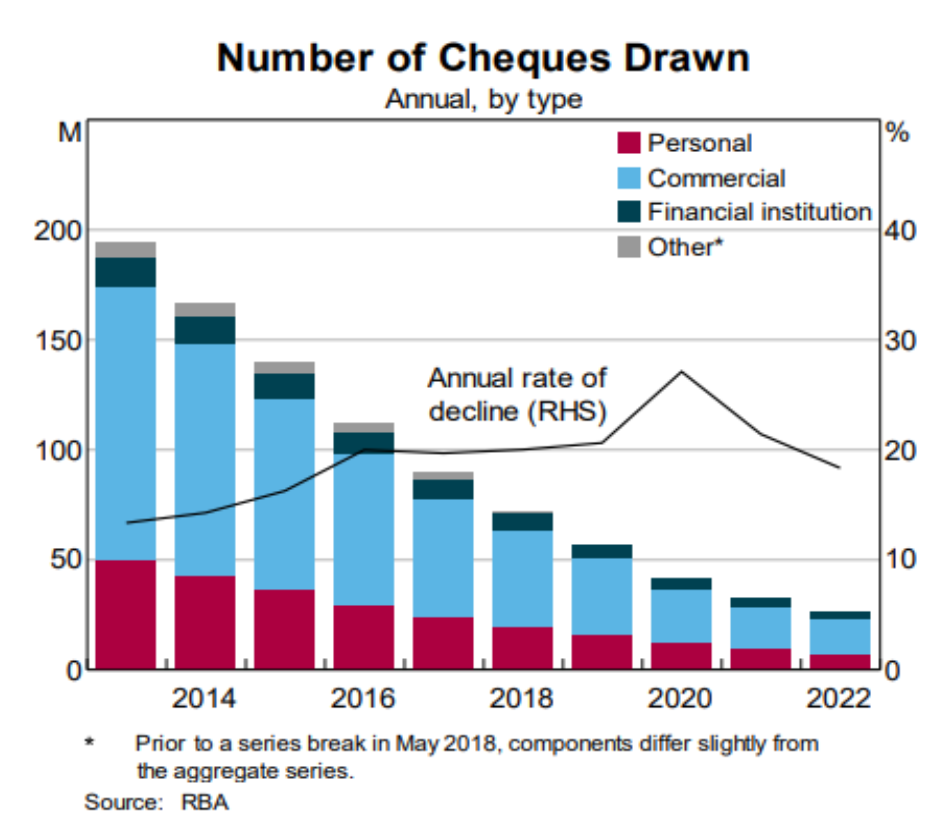

As Australia moves towards becoming a cashless society and phasing out cheques by 2030, you might find yourself at a crossroads in adapting to new payment methods.

With cheques disappearing and cash transactions dwindling, mastering online banking or digital payment apps is essential, particularly if technology isn’t your strong suit.

Consider the simple act of paying for groceries or settling a café bill—increasingly, you’ll find that only digital payments are accepted.

This shift can be especially challenging since according to the NSA about 400,000 of the 500,000 personal cheques processed monthly in Australia are written by seniors, indicating a strong reliance on traditional banking methods among older Australians.

Research indicates that many older adults lack the digital skills necessary to effectively use online banking systems, leading to their social exclusion.

The eSafety Commissioner’s website highlights that numerous older Australians do not engage with the internet and perceive the digital society as not integral to their everyday lives.

This lack of engagement restricts their ability to perform essential tasks such as paying bills or shopping online, which are increasingly available only through digital channels.

Simple Steps for Seniors to Embrace Modern Financial Tech

Times are changing fast, and so is the way we handle money. It’s important for you to keep up so you can take care of things on your own and stay connected. Let’s look at how you can get comfortable with today’s financial tech.

Securing a Credit Card

- Understand Eligibility Requirements: Familiarise yourself with the requirements for obtaining a credit card, such as income thresholds and identification needs. Consulting with financial advisors at banks or credit unions can provide clarity and personalised advice.

- Explore Secured Credit Cards: If obtaining a standard credit card is challenging, consider a secured credit card. These cards require a cash deposit that serves as collateral against the credit limit and can help build or rebuild credit.

Increasing Credit Rating

- Regularly Check Credit Reports: Obtain a free credit report from major credit bureaus to check for inaccuracies or fraudulent activities. In Australia, individuals are entitled to one free report per year from agencies like Equifax, Experian, and Illion.

- Manage Credit Cards Wisely: Use credit cards for small purchases and pay the balance in full each month. This demonstrates reliable repayment behaviour and can positively impact credit scores.

- Diversify Credit Types: Having a mix of credit types, such as a retail account, mortgage, or personal loan, can improve a credit score as long as these are managed responsibly.

Adapting to Financial Technology

- Digital Literacy Workshops: Participate in workshops or classes designed for seniors to learn about digital tools and financial apps. Libraries, community centres, and organisations like the eSafety Commissioner often offer such programs.

- Practice with Assistance: Initially, practice using new technologies with the help of family members, friends, or volunteers who can provide one-on-one support.

- Use Trusted Financial Apps: Engage with well-known financial apps that have robust security measures in place. Start with basic functionalities like checking account balances or making transfers, and gradually move to more complex transactions.

General Tips

- Stay Informed: Keeping up with new technologies and financial products by reading trusted sources or attending informational sessions can help seniors stay current and make informed decisions.

- Seek Professional Advice: Consulting with financial advisors can provide insights tailored to individual financial situations and help navigate the complexities of credit and technology.

Reverse Mortgages: A Viable Alternative for Seniors

If you’re finding it tough to get a credit card because of recent banking changes, a Reverse Mortgage might be a smart choice for you. This type of loan lets you tap into the value of your home, giving you access to a credit line without the need for regular repayments.

Here’s how it works: a Reverse Mortgage allows you to borrow money against the equity you’ve built up in your home. You don’t have to pay it back regularly like a traditional loan. Instead, the loan is typically repaid when you sell your home, move out permanently, or pass away. This setup can offer you a lot of flexibility with your finances, especially if your income isn’t what it used to be.

You can use the money from a Reverse Mortgage for almost anything—whether it’s covering daily expenses, paying for medical care, or even funding a well-deserved holiday. It’s a way to keep your financial independence without the stress of monthly loan repayments.

Think of it as a safety net that lets you use the wealth you’ve worked hard to build in your own home. So, if you’re feeling pinched by the digital push in banking and the tough credit card applications, looking into a Reverse Mortgage could be a wise step.

Want to learn more about Reverse Mortgage? Find out more about how to use a Reverse Mortgage for debt consolidation or download your FREE REVERSE MORTGAGE GUIDE.

Ready to Apply? You can now check your eligibility online or call Seniors First on 1300 745 745.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.

I am 68 and still work part time in a lending broker office. I have zero debt and earn from investment and part time work over A$80K. My super is untouched and still increasing. I applied for a $2,000 credit card and Bankwest declined. No reason given. I have now lodged a complaint with Australian Human Rights Commission for age discrimination. Everyone should do this and maybe the government will do something about it.

In this article you mention “explore secured credit cards”, why, when to the best of my knowledge they are not available anywhere in Australia. Please correct me if I am wrong. These would provide an excellent option for retirees.

My other gripe is about the way one’s wife, as a long term secondary card holder, is treated should I die first. Once informed of the death the card issuers simply cut up both cards, close the account & leave her high & dry, no matter how good her credit score is, instead of simply allowing her to take over the account. Just not good enough.

Yes they appear to be rare in Australia, but it seems ANZ do it. Maybe check them out Victor

Banks are making it harder to access cash, I needed $1 coins x $210 for a quirky 21st birthday gift for my grandson but three Commonwealth Banks I visited refused to give me over $100. At Southland Commonwealth Bank (Vic) you can only take out $50 notes but the machine to change big notes for small notes has been restricted to business accounts so I can’t get a $20. If I can’t get a credit card as your article states, I am forced to withdraw and carry around excessive money which is a security risk, a drain on my finances and just plain discriminatory to older people.

I currently have 3 credit cards and applied with a different bank to get a better deal. I was knocked back because I don’t earn $36,000 per year. If I was a self-funded retiree with an income of that amount, I probably would have got it. I’ve found the same thing when I wanted to get some finance at Harvey Norman – $1300 for a new air conditioner. Got knocked back, so had to pay for it on credit card! Yet, I can borrow from Centrelink or get Paypal, pay in 4!! Go figure!

thanks Diane. Yes, sometimes the system doesn’t make any sense!

Actually, it is not just credit cards. Try getting aloan when you are over 50 or worse still, over 60. It used to be that banks would give you a 25 year loan but understood you wouldn’t be paying the loan off over the full 25 years, and that was fine because you would either downsize or die before then, and the equity in your home would pay the mortgage out. Now if you want a loan you need to have a short loan period (10 to 15 years) This is based around the retirement age of 67. This in turn makes the repayments unaffordable or you need to show that you can payout the loan by some other means (ie lump sum from super). In essence, even with high equity (50 to 80 percent) you will not be able to get a loan with a 25 year term.

Hi Roger, yes you have identified a big problem out there. Under the NCCP which was introduced about 15 years ago now the banks have to show an ‘exit strategy’ for most older borrowers (unless its a Reverse Mortgage). Certainly a big surprise & hassle for many who were not aware of the changes.

I am puzzled that this site does not mention the alternative of Debit Cards. I ran into the problem of establishing my income for a Credit Card while still working as I was self employed and the cost of an accountant to establish my income was significant. Bendigo Bank offered a Debit Card which enabled on-line transactions. I still use a Debit Card for all on-line activities. This card is attached to a special savings account that I keep with just enough money to pay for expected transactions. This way any unauthorised withdrawal will ring alarm bells.

Hi Celia, thanks you make a good point. Debit cards are wonderful, but the reality is some people need access to a little credit from time to time to get by. The issue is that many seniors have taken for granted they can get a credit card, and are shoccked & surprised when that is not the case.

In my late sixties I had a credit card with Bank West for $20000. I went to use the card and they had decreased the limit, to $6000 without advising me. I asked them why, they said they thought I could no longer afford it due to my age. This wasn’t true. I told them they were discriminating. Too bad. It was done.

The same here! I had one credit card with $12000 limit, it was suddenly reduced without notice to a measly useless $500! I had maintained that account impeccably for many years, regular payments of the balance owed and sometimes even a credit balance above. The same as with 2 other credit cards in different banks. I also had a good credit rating. They too gave me the same sort of waffle as a reason, also said that I obviously did not need that amount as I did not usually use up to near the limit. I believe we had a contract, how can they get away with this sort of action?

I would have thought that was a case of discrimination against people over 55. We are more likely to pay it back than the younger generation.

Yes, we are a very risk-averse generation. We lived through the 1970s financial crisis, when mortgage rates almost doubled, rising from 5% to a previously unimaginable 10% between 1970 and 1974. And then we survived 18% mortgage rates in the late 1980s.

Hi Penny, thanks for your comment. Yes, in the wider context of the 18% rates in the 80’s the current interest rates are actually not that high. Certainly they are near the long term average. The problem is that the debt to service ratio (DSR) of the average family today is much higher than 30-40 years ago. (this coincided with the deregulation of the banking industry).

This is discriminating against a certain group of people, perhaps the Minister for health and aged care should be looking into this or someone bring it to the attention of the Minister

The banks dislike retirees. They only want customers who are in paid employment because that’s all they understand. They just parrot the mantra ‘responsible lending’ as a get-out excuse for thinking or addressing the customer’s specific financial circumstances, which could be substantial. And they all use the same proforma/software.

I do think this is unfair my husband and I have two credit cards issued when we were both working and earning two wages – I often think that they may have taken them away when we both retired but they didn’t. we use them for all our shopping and pay the full amount when the payment is due but have in the interim taken out a Reverse Mortgage so its never an issue to do that. this works well for me as I use the mortgage like a bank depositing spare cash from our pensions into it so as to reduce the compounding interest then draw down the amount I need to pay the credit card.

I can understand why the banks would do this as some of us are on limited and fixed incomes so could be potentially in trouble if we maxed them out then couldnt pay them

No, I do not agree with it at all. As we have reached this ‘golden age’ of retirement we have a well-established track record of our level of financial reliability either good or bad, and credit available should be based on that. If I have been a good financial manager all my life, no matter what size my income, then I am not going to change my values and practices just because my income may change, I will adapt my cost of living and spending as needed.

There is also the aspect of the right to personal responsibility to consider, and the utter rudeness entailed in bank actions and attitudes that we are discussing. If I am managing that account well, then just leave me alone and let me get on with it. If I decide to overspend and get myself into a real mess because of my own decisions, then they have the right to intervene to protect themselves and I have to suffer the repercussions.

That is not all .. I had a mortgage for $110k and needed to refinance it. Approached my bank, “no problems, we can do it”. …. i.e. until it came to my age .. think I was 66… no, can’t lend ( basically I was too old). Considering I stayed in full employment until 80, I think such an outlandish approach is purely discriminatory.

I was denied an increase to my credit card limit by the dishonest Bendigo bank even though I have a perfect credit rating and I will not live long enough to spend my super. The dishonesty from Bendigo was amazing, everybody LIED to me on numerous occassions and in print.