Reverse Mortgages are a unique financial tool available to homeowners, especially for those in their golden years. Instead of making regular repayments, this type of mortgage allows you to draw from your home’s equity, converting it into cash to support your lifestyle or other needs. But just like any other loan, there’s a catch: interest rates.

Understanding interest rates in the context of Reverse Mortgages is crucial. They determine how much you’ll owe in the long run and play a big part in how fast your loan balance grows. Surprisingly, there are a few misconceptions floating around about these rates, leading some to make uninformed decisions.

In this blog post, we’ll dive deep into why interest rates matter and debunk some common myths. Whether you’re new to the concept or just need a refresher, we’ve got you covered. So, let’s get started!

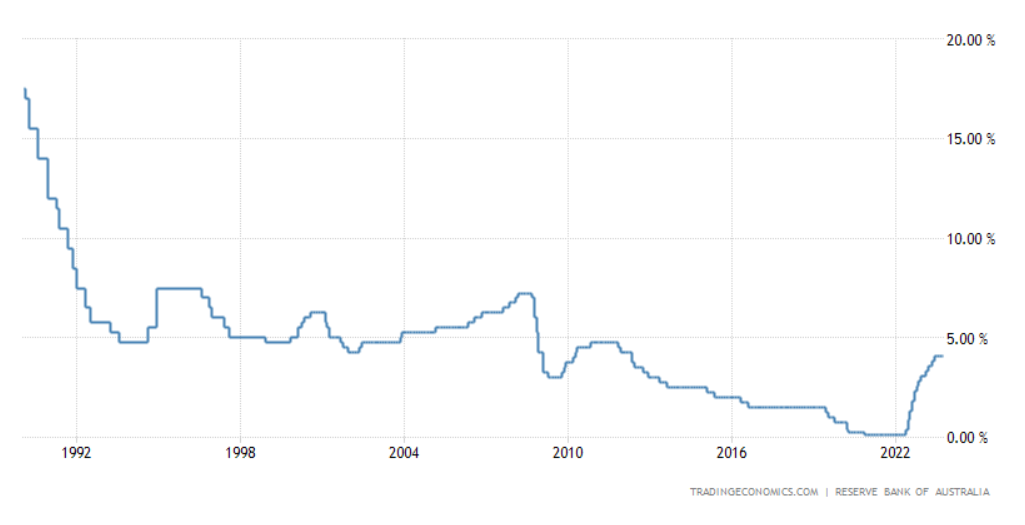

How the RBA Cash Rate Affects Reverse Mortgages

The RBA cash rate is a tool used by the Reserve Bank of Australia (RBA) to influence the broader economy. As of October 2023, the current cash rate in Australia is 4.10 %.

When the cash rate moves, it can impact the interest rates that banks and other lenders charge their customers. Simply put, if the RBA cash rate goes up, lenders can increase the interest rates they charge for various loans, including Reverse Mortgages. Conversely, if the RBA lowers the cash rate, interest rates may decrease.

This is vital to understand because a change in the RBA cash rate can influence the amount of interest accumulating on your Reverse Mortgage. Being aware of these changes and their potential impact allows you to make more informed decisions about your property and financial future.

To provide you a better perspective, below is the historical rates in Australia for the last 30 years.

Source: https://tradingeconomics.com/australia/interest-rate

The chart illustrates the trajectory of interest rates in Australia over three decades. From the heights of nearly 20% in the early 1990s due to the recession, rates steadily descended, influenced by events like the Asian Financial Crisis and the introduction of the GST in 2000. The 2000s saw rates stabilising amidst a mining and housing boom.

However, the Global Financial Crisis caused a significant dip, with the post-GFC period maintaining low rates, further dropping during the 2020 pandemic. As of 2022, a notable rise suggests potential economic rejuvenation post-COVID.

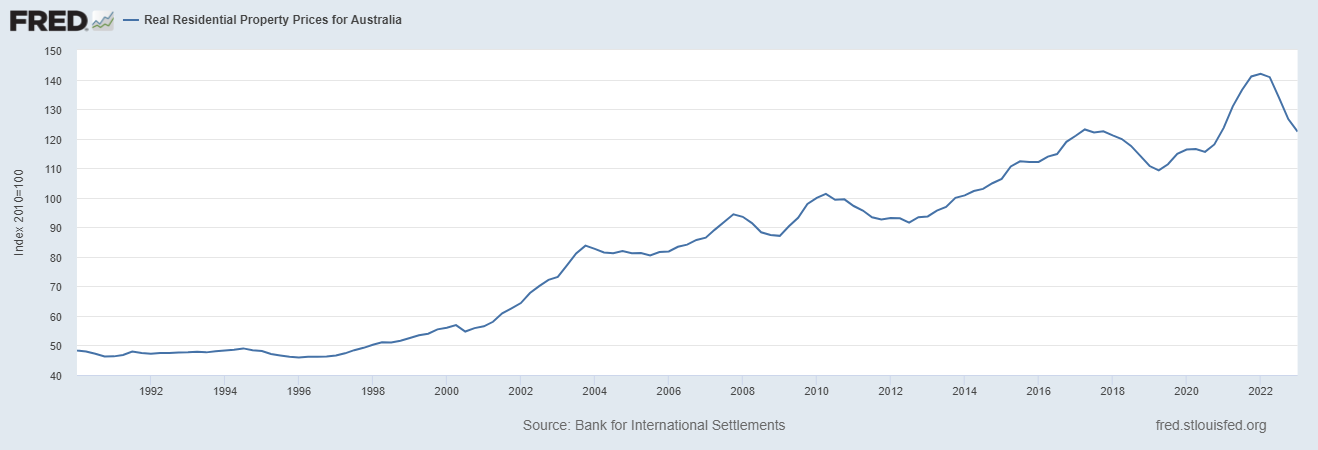

Here’s another chart showing real estate prices in Australia covering the same period.

Image source: https://fred.stlouisfed.org/series/QAUR628BIS#

Historically high interest rates in the 1990s made borrowing more expensive. But as interest rates began to decline, it made borrowing cheaper for Australians. This potential increased demand for housing, driving up property prices.

Even if the interest rates feel high right now, when we observe them historically, they are nearer to the average or even below average for much of the past three decades. Despite the oscillations in the interest rates, homeowners have seen a robust growth in property prices.

A useful exercise many homeowners undertake is to calculate how much the house has grown in value:

- Since it was purchased

- In the last 10 years

- In the last 5 years

This can help put any likely interest cost of a Reverse Mortgage in context. It’s essential to understand that Reverse Mortgages become most costly if you withdraw a large sum early on, maintain the loan for a very long duration, AND you don’t make any payments on interest. For those who gradually draw down funds or intend to have the loan for a relatively short term ( 5-10 years), costs are often reasonable, and may be better than downsizing.

[ Related Post: You Don’t Need to Sell Your Home to Finance Retirement ]

Even when interest rates experienced peaks or troughs, the nature of a Reverse Mortgage – which allows homeowners to convert part of their home equity into cash – remains fundamentally unaffected.

The repayment isn’t due until the homeowner sells the home, moves out, or passes away. This means that despite the fluctuations in interest rates over the years, the overall structure and benefits of a Reverse Mortgage stay consistent, ensuring homeowners can access their equity without the immediate pressure of interest accumulations.

The Myth: Higher Interest Rates and Their Perceived Disadvantages

For many Australian homeowners, the mere mention of “higher interest rates” can evoke a bit of anxiety. There’s a cloud of myths and misconceptions that hover around this topic, especially when it comes to Reverse Mortgages.

Firstly, the common fear: higher interest rates might mean higher costs and potentially growing debt. It’s easy to jump to the conclusion that when rates rise, a Reverse Mortgage could become a financial burden. However, it’s essential to understand the unique nature of these loans.

Reverse Mortgages aren’t like your typical home loans. With these, the interest accumulates over time and is added to the loan balance. The homeowner doesn’t need to make any repayments as long as they reside in the property. So, while it’s natural to think that higher interest rates would drastically increase costs, the real-world effect might be less significant than many imagine.

Another misconception revolves around the long-term impact of interest rates on a Reverse Mortgage. Many are under the impression that higher rates might rapidly diminish their home equity, potentially eroding the property’s value over the years. Though interest does accumulate, its growth on the loan isn’t solely dictated by the rate alone.

Three proactive strategies can ensure that Reverse Mortgage loans remain manageable despite higher interest rates:

- Structuring Reverse Mortgages appropriately

- Judiciously choosing the right lender

- Drawing funds gradually

Both these approaches can play a pivotal role in preserving your home equity for longer.

Structuring the Reverse Mortgage Correctly

A well-planned Reverse Mortgage not only provides homeowners with an avenue to tap into their property’s equity but also cushions against potential challenges, such as rising interest rates.

Variable Rates Take Centre Stage

In Australia’s Reverse Mortgage landscape, fixed rates have become a thing of the past. Notably, the last lender to offer this was Bluestone, and it led to a slew of early prepayment cost penalties for many homeowners.

Now, adjustable rates dominate, fluctuating based on market conditions and benchmarks like the RBA cash rate. While they can be unpredictable, adjustable rates also offer the chance of decreasing, which might be favourable if market dynamics shift in the right direction.

Impact of Reverse Mortgage Loan Terms

The ultimate term of your Reverse Mortgage profoundly influences overall costs. While shorter terms might mean lower overall interest costs, the amount of the principal borrowed is the key. The less you can borrow as a lump sum, and shorter you borrow the money for than the lower the overall cost.

It is increasingly common for people to use a Reverse Mortgage loan as a temporary fix, until they downsize and sell the home in 3 to 5 years. Such a short loan term will minimise the interest charges.

Strategising for Home Equity

A proactive approach to managing interest on a Reverse Mortgage is to service the monthly interest directly. By doing so, you can ensure that the loan balance doesn’t increase, thus preserving the equity in your home. Making monthly interest payments helps in maintaining a stable loan balance, allowing homeowners to safeguard the value tied up in their properties.

The Importance of Choosing the Right Lender

Diving into the world of Reverse Mortgages means navigating an ocean of choices, and one of the most crucial decisions homeowners face is selecting the right lender.

While it might be tempting to go with the first or most advertised option, it’s essential to remember that lenders, much like the offers they provide, are not created equal.

Varied Rate Structures and Benefits

Lenders differ in their offerings, and some might present rate structures or perks that align more closely with your needs than others. Shopping around and comparing can illuminate these differences, allowing homeowners to make an informed decision.

Transparency Matters

When it comes to financial decisions, clarity is paramount. Opting for lenders who lay out their terms transparently, providing detailed breakdowns without hidden fees or conditions, is non-negotiable. After all, understanding the nitty-gritty of a Reverse Mortgage ensures you’re not caught off guard later on.

Track Record and Fairness

A lender’s history can offer insights into their business ethics. Those with a longstanding reputation for fairness often become the preferred choice. Reviews, testimonials, and industry accolades can serve as indicators of a lender’s commitment to their clients’ best interests.

Prioritising Customer Service

Especially pertinent for seniors, exceptional customer service can make all the difference. The Reverse Mortgage journey can be intricate, and having a supportive lender team – one that’s ready to offer guidance, answer queries, and simplify complexities – can be invaluable.

While Reverse Mortgages provide a pathway to financial flexibility, it’s the lender behind the offer that often determines the journey’s smoothness. As with any significant decision, research, patience, and due diligence are key. Australian homeowners, equipped with the right knowledge, can then partner with a lender that truly has their back.

In summary, while higher interest rates might seem daunting at first glance, they don’t need to be a deterrent. With the right information, support, and perspective, seniors can make informed choices about their Reverse Mortgage, ensuring it aligns seamlessly with their financial aspirations.

Drawing Loan Funds Gradually

One of the significant benefits of a Reverse Mortgage is its flexibility, allowing homeowners to access the equity in their home in a way that suits their financial needs. However, in a climate of fluctuating or higher interest rates, the way homeowners choose to draw down their reverse mortgage funds can have a significant impact on the total interest accrued. One strategy that is gaining traction for its financial prudence is drawing funds gradually.

Benefits of Drawing Funds Gradually

Manageable Debt Accumulation

By taking out funds over time rather than as a lump sum, homeowners can reduce the amount of interest that accumulates on the loan. This is because interest on a Reverse Mortgage compounds on the outstanding balance. A smaller balance, especially in the initial years, means less interest compounding.

Cash Reserves

Some Reverse Mortgage products offer a cash reserve option. This option allows homeowners to establish a reserve of funds they can access as needed. It’s akin to having a line of credit, where interest is only charged on the amount drawn down.

Monthly Advances

Another alternative is to take monthly advances. Instead of accessing all the funds upfront, homeowners can choose to receive a monthly amount, which can help with regular expenses, thereby spreading the loan balance over time.

Let’s take a look at the difference in interest accrual when drawing $100,000 at once versus over a period of 10 years at an interest rate of 8.5%.

Lump Sum: If you took out $100,000 AUD immediately:

Year 1: $100,000 + 8.5% = $108,500 (simple interest)

Year 10: Using compound interest, the amount owed would be approximately $229,378.

Gradual Drawdown: If you took out $10,000 AUD annually over 10 yearrs:

Year 1: $10,000 + 8.5% = $10,850 (simple interest)

By Year 10, including each annual drawdown and compounding interest, the amount owed would be approximately $158,948.

The difference between the two strategies is substantial. After 10 years, by drawing down gradually, a homeowner would owe $70,430 less than if they had taken the lump sum.

Drawing funds gradually from a Reverse Mortgage can be a proactive strategy, especially in an environment of higher interest rates. By understanding and utilising the available options like cash reserves or monthly advances, you can ensure that their loan remains manageable, reducing the total interest bill over the life of the loan.

Before deciding on any drawdown strategy, it’s crucial to consult with a Reverse Mortgage broker to determine the best approach for your individual circumstances.

Other Factors to Consider When Choosing a Reverse Mortgage

In exploring Reverse Mortgages, there’s more to think about than just rates:

- Fees: Just like with any loan, Reverse Mortgages come with their set of fees. This might include upfront costs, ongoing fees, or charges for specific services. Always ask your lender for a clear breakdown.

- Loan Limits: Different lenders might offer different amounts. Make sure the amount you’re getting fits what you need and that you’re comfortable with the repayment structure.

- Reputation of the Lender: A good track record says a lot. Look for lenders known for their transparency, customer service, and fairness. It’s your home on the line, so trust is paramount.

IMPORTANT: don’t go at it alone. Making financial decisions, especially big ones, can be a bit daunting. Consulting with a financial advisor or mortgage broker can be a game-changer. They can help you navigate the options and find a Reverse Mortgage that’s just right for you.

Remember, this is about your comfort and security in your later years. Taking the time to make a well-informed decision will give you peace of mind for the future.

Ready for the Next Steps?

Understanding the details of Reverse Mortgages can seem challenging, but with the right guidance, you can find a solution tailored to your needs.

Seniors First is dedicated to assisting you through this process. Whether you’re just starting your journey or need some final pointers, their expertise can make all the difference.

Ready to take the next step? Check your eligibility here or call us on 1300 745 745.

Disclaimer: This blog is intended for informational purposes only. It’s essential to seek advice from a financial expert or mortgage broker specific to your circumstances before making any decisions.

Hi ,

Have been considering a reverse mortgage for some time and ready for the next step and would like know the charges involved I.e set up valuation, settlement fees for existing mortgage ,on going annual or monthly fees and if there are charges for transfer when a draw down is involved and what the procedure is to do so, and of course why senior first.

Regards Richard and Vicky Jeggo

Hi Richard & Vicky,

Thank you for leaving a comment. We will have a team member call you shortly.

Kind Regards,

Seniors First