The conventional Australian retirement planning dream is to retire debt-free. But the reality is that in 2024, this fairly modest objective has become increasingly elusive. A growing number of Australians are facing the prospect of entering their golden years still burdened by mortgage debt.

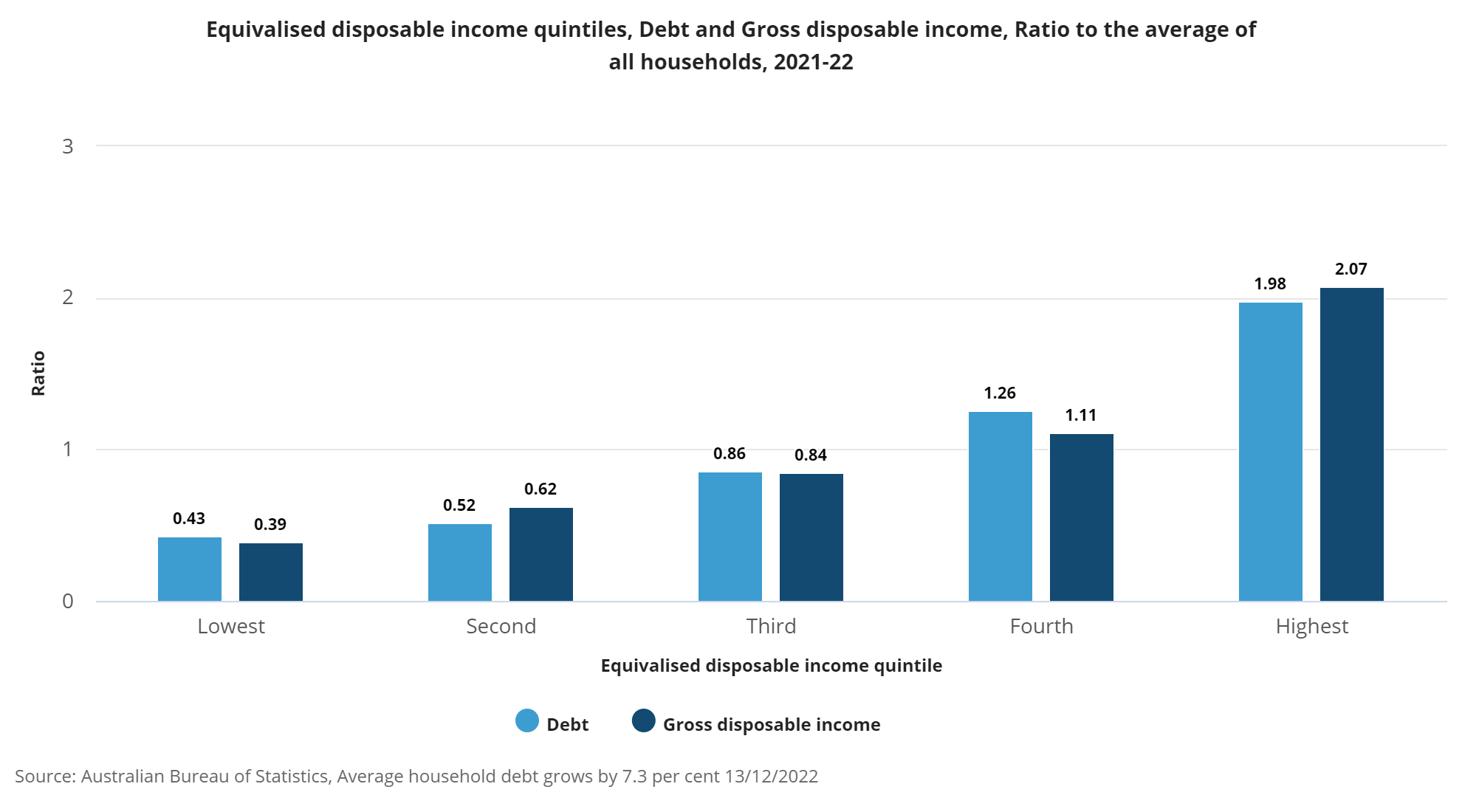

Recent research, including a pivotal study from AMP and critical data from the Australian Bureau of Statistics, paints a clear picture: the level of mortgage debt among Australians over 50 is at an all-time high.

Imagine, two decades ago, the average household debt for those aged over 55 was a mere fraction of what it is today. Now, it’s not uncommon to retire with a significant mortgage still hanging over your head.

What does it mean for retirement planning? And why is this happening, you might wonder? Well, it’s a complex mix of factors:

- Rising House Prices: One of the primary factors contributing to this trend is the substantial increase in house prices over the years. This surge has outpaced wage growth, leaving many retirees struggling to keep up with mortgage repayments.

- Changing Retirement Age: The average retirement age in Australia is rising, which gives individuals longer in the workforce to pay off their debt. However, this also means carrying larger debts into later life, posing a risk if plans go awry.

- Use of Mortgages for Other Purposes: Some Australians are using their homes as security for other financial endeavours, like investing in properties, which keeps their mortgages open.

- Government Policies: Assistance policies like first home buyers grants have inadvertently contributed to higher house prices, affecting the ability of retirees to pay off their mortgages.

[ Related Post: Retiree Debt Trends: Home Equity Release Helps Over 60’s Cope With Soaring Debt ]

Impact of Mortgage Debt on Retirement Plans

Carrying a mortgage into retirement can be risky. It exposes you to financial vulnerabilities, especially if unexpected health or employment issues arise. Indebtedness in later life can lead to psychological distress and could impact your well-being more profoundly than it might have earlier in life.

Moreover, as mortgage debt increases, it can lead to after-housing-cost poverty among older Australians. This situation might call for an increase in the age pension to support those in need. The trend also puts pressure on government resources, as more people might require rental housing assistance if they lose homeownership.

If you’re approaching retirement with a mortgage, it’s important to take proactive steps. Consider reviewing your retirement plans, reducing expenses where possible, and reassessing your financial strategies. Using super lump sums to pay down mortgages is becoming a common practice, with around 29% of such withdrawals in 2017 used for this purpose.

Remember, your home is likely your most valuable asset in retirement. Understanding how to manage this wealth effectively can enhance your retirement income. Options like Reverse Mortgages might be worth exploring.

Reverse Mortgages: a retirement planning solution for seniors in debt?

If you’re an Australian senior concerned about retiring with debt, Reverse Mortgages might be a solution worth considering. Let’s break down what they are and how they could benefit you.

What is a Reverse Mortgage?

A Reverse Mortgage is a loan designed for pensioners and retirees. It allows those typically ‘asset rich’ but ‘cash poor’ to convert the equity in their property into cash. This type of loan is particularly popular in Australia for those aged 60 and above.

The key feature of a Reverse Mortgage is that, unlike traditional loans, you don’t need to make repayments while living in your home, although voluntary payments are possible.

The amount you can borrow depends on your age, the value of your home, and other lender criteria. Generally, the older you are, the more you can borrow. For instance, at age 60, you might be able to borrow 15-20% of your home’s value, with this percentage increasing as you age.

[ Related Post: How Reverse Mortgages Align with Australia’s Ageing Demographics ]

Benefits of a Reverse Mortgage

- Access to Cash: You can use the money for almost any purpose, such as home renovations, medical expenses, or even just to enjoy your retirement years more fully.

- Stay in Your Home: One of the biggest advantages is that you can remain in your home while accessing its equity.

- Retain Ownership: You still own your home, and any potential increase in its value remains yours.

- Flexible Drawdown Options: You have the option to access the loan as a lump sum, regular income, or a cash reserve.

Given the long-term financial impact, it’s vital to get independent financial or legal advice before proceeding. This will help you understand how a Reverse Mortgage might affect your Age Pension eligibility, future living expenses, aged care options, and what you leave for your family.

Learn more about Reverse Mortgages here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.