As we look back on 2023, it’s clear that it’s been a significant year for the senior population in Australia. This year has seen a variety of developments that have directly impacted the lives of those aged 65 and over, a demographic that now comprises 16% of the nation’s total population. With an ageing population due to increased life expectancy and declining fertility rates, the percentage of older Australians has continued to grow, shaping not just their individual lives but also the broader societal landscape.

Understanding these changes is vital. They influence everything from healthcare and housing to income and employment. This year’s developments reflect a complex interplay of policy decisions, economic shifts, and social trends. They highlight both the progress made in addressing the needs of older Australians and the challenges that persist.

In this reflection on the year 2023, we’ll look back into the key events, statistics, and policy changes that have marked this year as a significant one for Australian seniors. From shifts in pension policies to changes in healthcare access, each development offers insights into the evolving landscape of senior living in Australia. Join us as we explore how these changes have influenced your life and the lives of other seniors across the nation.

Inflation Impact: A Double-Edged Sword for Age Pensioners & Self-Funded Retirees

This year, Australian seniors have faced the dual realities of inflation and its impact on pensions. As inflation rates fluctuate, so too does the value of your pension. Let’s unpack how this has unfolded and what it means for your everyday life.

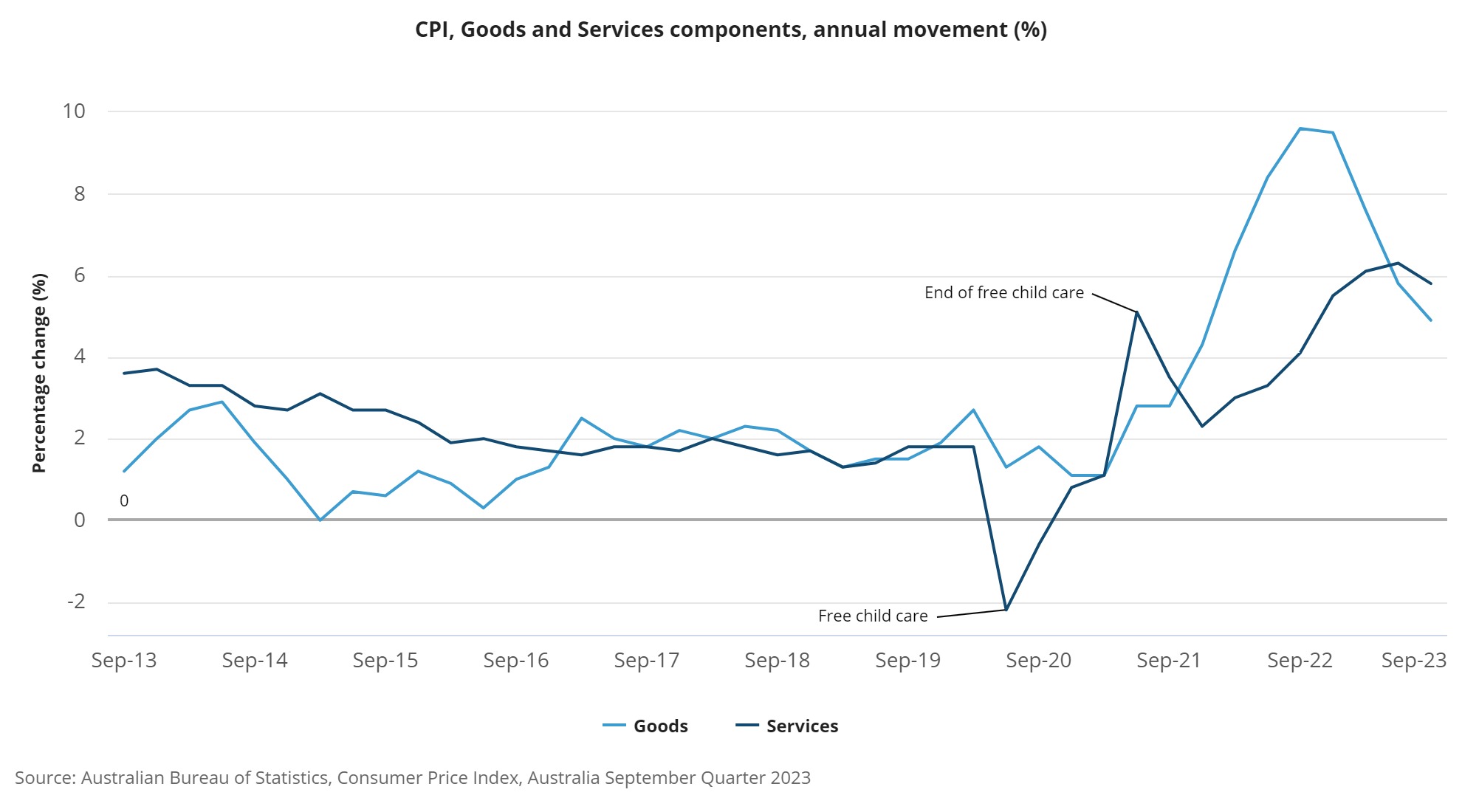

The Consumer Price Index (CPI), a key measure of inflation, indicated a 2.2% increase in pensions as of September 2023, translating to a rise of $23 per fortnight for a single pension and $35 for a couple’s combined pension. This adjustment, though welcome, may not fully match the actual cost of living increases, especially considering the varying impact of the Pensioner and Beneficiary Living Cost Index (PBLCI) – an index reflecting the spending habits of older Australians.

Earlier in the year, from March 2023, there was a rise in the single age pension by $37.50 per fortnight and for couples, by $56.40 per fortnight. This was a response to an inflation rate that had hit 7.8% over the previous six months. While these increases are crucial for keeping up with rising living costs, they often lag behind the actual rate of inflation. This delay can leave you playing a costly game of catch-up, as pension adjustments occur only every six months.

One of the tangible effects of inflation has been seen in rising food prices. For instance, food prices increased by 1.6% over the June quarter, affecting everything from meals out to basic groceries like fruits, vegetables, and bread. Factors like weather conditions affecting potato crops have had a direct impact on prices for staple food items.

The reality is that for many retirees, the cost of essentials like food, fuel, and electricity takes up a significant portion of retirement incomes, such as Age Pension. When these costs rise faster than your pension does, it can lead to financial strain. The call by advocacy groups for more frequent pension adjustments every three months during periods of high inflation is a reflection of these challenges.

In essence, while pension increases are a critical buffer against inflation, the timing and magnitude of these adjustments are just as important. It’s about striking a balance between maintaining a stable income and ensuring that this income keeps pace with the real-world costs you face every day.

On the other hand, rising interest rates in response to inflation is providing more income for some retirees. Those with cash investments in term deposits are enjoying better returns than they have for a decade or more.

Empowering Senior Employment: Ups and Downs

In 2023, the landscape of senior employment in Australia has been marked by significant advancements and lingering challenges. On the bright side, the workforce participation of older Australians, aged 65 and over, has seen remarkable growth. As of April 2021, approximately 619,000 older Australians were actively employed, with a substantial increase in participation rates over the past two decades. This change underscores a shifting trend towards extended working life, driven by both necessity and choice.

Interestingly, the employment pattern among seniors is evenly split between full-time and part-time roles. About 49% of older employed persons were engaged in full-time work, while 51% opted for part-time employment. This reflects a diverse range of needs and preferences among seniors, with many continuing to contribute significantly to the workforce.

However, it’s not all smooth sailing. The COVID-19 pandemic has notably impacted employment trends, with significant declines observed in the older age groups of the workforce. Additionally, underemployment and unemployment remain concerns, with 6.1% of employed seniors being underemployed and an unemployment rate of 2.9% among this demographic. This indicates that while opportunities are increasing, there are still hurdles to overcome in ensuring meaningful and satisfying employment for all seniors.

As we look towards the future, it’s crucial to balance these ups and downs. Encouragingly, initiatives like the increased Age Pension Work Bonus are steps in the right direction, empowering seniors to stay in the workforce longer without penalising their pension benefits. However, addressing the challenges of underemployment and adapting to the evolving needs of an ageing population will be key to truly empowering senior employment in Australia.

[ Related Post: Australian government encourages more pensioners to go back into work ]

Housing & Care: Steps Forward, Hurdles to Overcome

Australian seniors have witnessed several policy changes aimed at improving housing and care options. These changes represent significant steps forward but also highlight ongoing challenges in the sector.

Key Policy Changes and Their Implications

- Increased Rent Assistance: The Budget has introduced the largest increase in Commonwealth Rent Assistance (CRA) in over three decades. This 15% rise is expected to benefit older people residing in retirement villages and land lease communities, positively impacting about 1.1 million households.

- Expansion of Home Care Packages: The government’s commitment of $166.8 million for an additional 9,500 home care packages illustrates a focus on supporting older Australians who prefer to stay at home for longer. This expansion is part of Australia’s broader attention to the care economy.

- Improved Wages for Aged Care Workers: A significant investment of $11.3 billion supports a 15% provisional increase in the minimum wages of numerous aged care workers. This decision is set to benefit over 250,000 workers, potentially improving the quality of care received by seniors.

- Other Supports: Other enhancements include higher Job Seeker provisions for those aged 55+, reduced costs of medicines, increased bulk billing of medical visits, and tax incentives to boost the Build-to-Rent housing supply.

Source: homesuite.com.au

Persisting Challenges

Despite these positive developments, challenges remain. Staff shortages in the aged care sector are a significant concern, impacting the delivery of services. While home care wait times have reduced to a maximum of three months, the scarcity of skilled workers continues to be a hurdle in meeting the rising demand for in-home care.

Financial Year 2023-24: Mixed Fortunes for Seniors

The financial year 2023-24 has been a period of both gains and challenges for Australian seniors, marked by a variety of policy changes.

| Beneficial Policy Changes | Potential Setbacks |

| Superannuation Guarantee Increase: Employers now contribute 10.5% of wages to superannuation, up from 10%, with further increases planned until it reaches 12% by 2025. This change benefits those seniors still in the workforce, potentially increasing their retirement savings.

Downsizing Contribution to Superannuation: Seniors over 60 can now contribute up to $300,000 from the sale of their primary residence to their superannuation fund, a scheme previously limited to those aged 65 and over. Home Equity Access Scheme Enhancements: This scheme, allowing seniors to draw on their home equity, now includes an advance payment option and a no negative equity guarantee, providing more flexibility and security. |

End of the Low and Middle Income Tax Offset (LMITO): This financial year marks the last in which taxpayers can utilise the LMITO, which included a one-off $420 ‘cost of living tax offset’.

Variability in Superannuation Benefits: While the superannuation guarantee has increased, the benefit varies. Some employers may choose to cover the additional cost by reducing the take-home pay of employees, potentially affecting seniors who still work. |

Source: nationalseniors.com.au

Understanding the nuances of these changes can help you make informed decisions about superannuation, tax, and home equity to optimise your financial security in the coming year.

Healthcare Innovations: Bright Spots and Blurred Lines

The year 2023 saw an increase in government funding for aged care services, including substantial investment to enhance the wages of aged care workers and expand the availability of home care packages, a response to the Royal Commission’s findings of funding inadequacies.

The sector has also focused on addressing workforce shortages by improving employment prospects, training, and career pathways. However, challenges in recruiting and retaining skilled workers due to comparatively low wages and demanding conditions persist.

Quality of care remained a crucial concern, with the government implementing reforms to address issues identified by the Royal Commission. This includes enhancing regulatory oversight and increasing staffing ratios to ensure better care for older Australians.

Moreover, the integration of technology in aged care, such as telehealth services and remote monitoring systems, has offered innovative solutions for improving health outcomes and enabling ageing in place. Yet, despite these advancements, complexities like funding model limitations and pressures on the workforce underline the need for continued attention and improvement in the sector.

[ Related Post: How a Reverse Mortgage Can Help Seniors with Healthcare Costs ]

Looking Ahead for Australian Seniors

As we reflect on 2023, it’s clear that it has been a transformative year for Australian seniors, marked by significant policy changes and sector advancements. The increase in government funding for aged care, improvements in healthcare technology, and steps towards better aged care quality and workforce development have set the stage for a more supportive future. These changes suggest a trajectory towards enhanced care and support for seniors, indicating a more secure and fulfilling lifestyle in the years ahead.

Looking towards 2024, it’s important for you, as a senior Australian, to stay informed and engaged. Here’s a checklist for 2024:

- Review Changes in Aged Care Policies: Stay updated on the latest aged care reforms and how they impact you.

- Explore Technological Advancements: Embrace new technologies in healthcare for enhanced independence and well-being.

- Financial Planning: Consider adjusting your financial plans to cater for changes in pensions, superannuation, and healthcare funding.

- Engage with Community and Advocacy Groups: Stay connected with groups that represent senior interests to voice your concerns and stay informed.

- Healthcare Monitoring: Keep a close eye on healthcare provisions, especially changes in Medicare, pharmaceutical benefits, and home care services.

Thank You from the Seniors First Team

As the festive season of Christmas and New Year approaches, we at Seniors First extend our warmest thanks for your engagement with our blog. Your active participation and invaluable feedback inspire us to continue delivering insightful and valuable articles in 2024 and beyond.

We are dedicated to exploring the complexities and triumphs of ageing, ensuring you remain well-informed and supported during your golden years.

Here’s to a future brimming with progress, understanding, and unwavering support for all Australian seniors. Merry Christmas, Happy New Year, and cheers to the journey ahead!

g