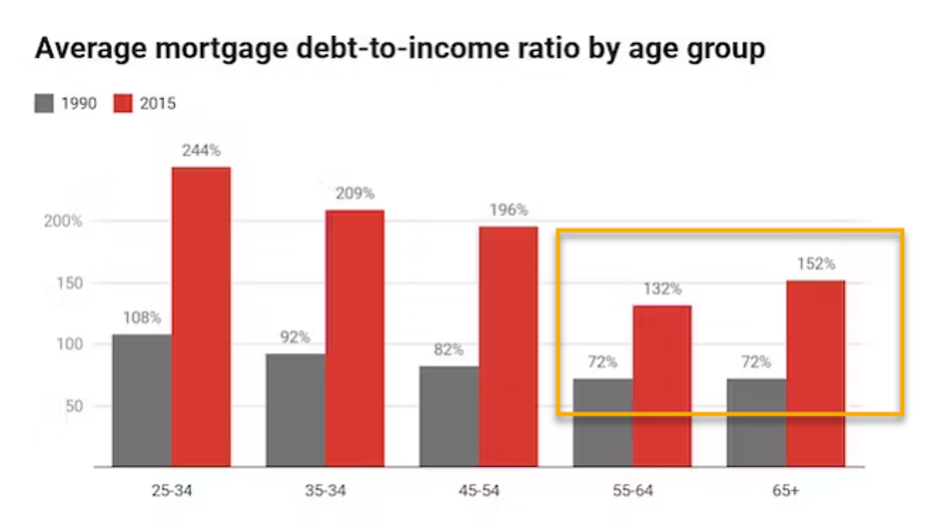

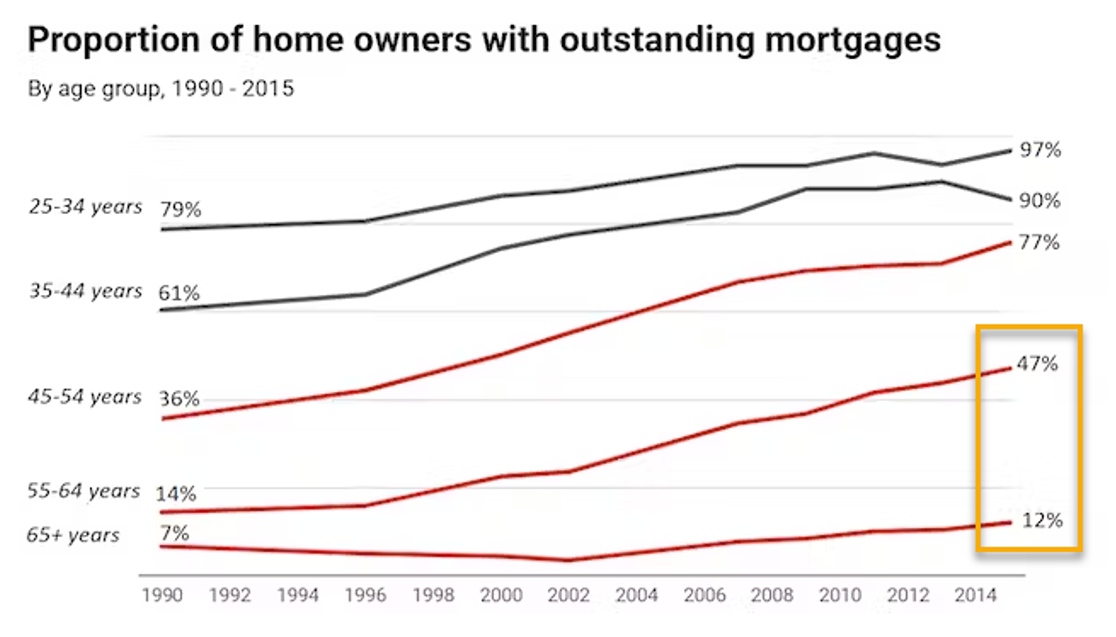

Australia’s seniors are facing a financial challenge that was uncommon just a couple of decades ago. According to The Conversation Australia, the ratio of mortgage debt to income for people over 55 has alarmingly doubled in the past 25 years. This trend signals a major shift in our retirement landscape and has implications for all seniors, especially pre-retirees, age pensioners, and self-funded retirees.

The issue isn’t confined to a particular group. The proportion of 55-64 year old homeowners still burdened with mortgage debt has tripled over the past quarter-century. Even those who are 65 and older are not exempt. In this age bracket, the proportion of homeowners with mortgage debt has nearly doubled. This shows that this financial predicament isn’t an isolated issue but a sweeping trend that affects a broad spectrum of our senior population.

What’s behind this escalating trend? One key factor is the widening gap between wage growth and property values. Wage rises haven’t kept up with the increase in property values. Consequently, to afford housing, Australians now have to borrow more relative to their income. This scenario can put seniors in a precarious financial situation, making it harder for them to clear their mortgages before retiring.

Adding fuel to the fire, the recent rise in inflation and the cost of living are exacerbating an already complex problem. As living expenses go up, it can be challenging for seniors to allocate sufficient funds to pay down their mortgages. The cost of basic necessities, healthcare, and utilities can strain the budget, leaving little room for significant mortgage repayments.

This escalating issue requires attention and action, particularly for those approaching retirement or already retired. Understanding the trend and the factors contributing to it is a vital first step. Exploring potential solutions, like using a Reverse Mortgage for debt consolidation, could be an effective strategy for some.

You are Not Alone: Understanding Retiree Debt in Australia

If you’re approaching retirement (or already retired) with a cloud of mortgage debt overhead, it’s important to know you’re not alone.

In recent times, it has become increasingly common for Australians to enter their golden years with lingering debt on their homes. Various factors contribute to this situation, making it challenging for retirees to navigate their financial circumstances.

What Makes Retirement Debt Spiral Out of Control?

Several circumstances can push retiree debt into unmanageable territories, some of which might be unexpected life events.

Widowhood: The passing of a spouse often leaves the surviving partner with reduced income while most costs remain the same, exacerbating financial pressures.

Divorce: Late-life divorces are becoming more common, and they often require individuals to borrow more to fund settlement payouts to ex-spouses, adding to their debt load.

Early Forced Retirement: Job loss in the 50s and 60s can make it difficult to secure another income source or access superannuation, leaving individuals with less financial buffer to manage their debts.

Higher Interest Rates: When interest rates rise, the cost of servicing any existing debt also increases, leading to higher repayments.

Inflation and Cost of Living: With inflation steadily eroding real incomes, retirees find it tougher to manage their existing debts.

Strata Levies: Unexpected levies imposed by body corporates can add another layer of financial burden to retirees, especially those already juggling various expenses.

Common Coping Strategies for Retiree Debt

At Seniors First we have observed that retirees resort to various strategies in response to growing debts, before they approach us. Some take on more credit card debt (typically the most expensive option), borrow from family, or leverage ‘buy now, pay later’ schemes. Others opt for the Home Equity Access Scheme (HEAS) for amounts under $20,000 or seek advice from a financial counsellor.

Hardship arrangements with existing lenders, dipping into remaining savings, or managing from limited cash flow are other common strategies. Some even compromise on life’s necessities, such as reducing heating in winter, to meet financial obligations.

(NOTE: we are not advocating for any of these actions, it is an observation of consumer behaviour only).

The Psychological and Physical Toll of Personal Debt

Carrying significant debt into retirement can lead to feelings of:

- Disempowerment

- Unhappiness

- stress.

Many retirees describe feeling “poor” despite years of hard work. It can deeply impact their mental health, contributing to:

- Increased anxiety

- Depression

- Sleeplessness.

Debt-related stress also takes a toll on physical health, potentially leading to elevated blood pressure, lowered immunity, and chronic aches and pains. Relationships can suffer too, with increased marital conflicts, family arguments, and social isolation frequently reported.

While these challenges are substantial, remember you’re not alone, and there are ways to navigate this complex landscape.

One potential solution is the use of a Reverse Mortgage for debt consolidation. As we move forward in this guide, we’ll explore this option, keeping our language simple, approachable, and friendly. Remember, it’s always wise to seek professional advice tailored to your unique financial circumstances.

Using a Home Equity & Reverse Mortgage for Debt Consolidation

As financial stress mounts during retirement, one option worth exploring is using home equity release, via a Reverse Mortgage. By consolidating multiple debts into a single Reverse Mortgage loan, you could potentially benefit from a more favourable cash flow.

What is a Reverse Mortgage?

A Reverse Mortgage is a loan that allows homeowners to access the equity in their homes, providing much-needed cash flow during retirement. One key application of a Reverse Mortgage is debt consolidation.

What Debts Can be Refinanced with a Reverse Mortgage?

A Reverse Mortgage can be used to pay off a variety of debts, including:

- Home loans

- Credit cards

- Personal loans

- Consumer credit

- ‘Buy now, pay later’ debt

- Tax debt

- Loans owed to family

- Residual business debt

- Council rates debt

- Strata levy debt

However, certain types of debts are not eligible for refinancing with a Reverse Mortgage. These include gambling debts, debts in company names, current business debts, and those associated with seriously ‘bad credit’.

Pros and Cons of Using a Reverse Mortgage for Debt Consolidation

Using a Reverse Mortgage for debt consolidation can offer significant benefits, such as:

- eliminating the need for monthly repayments

- potentially lowering interest rates

- streamlining multiple debts into one manageable loan

However, there are downsides to consider as well. Reverse mortgages generally have higher interest rates than traditional mortgages. Interest is ‘capitalised’, meaning it’s charged back to the loan account and compounds over time. Unless you make voluntary payments, the loan balance will increase. There are also setup costs to consider.

How Does a Reverse Mortgage Work?

A Reverse Mortgage, like standard home loans, is secured by the first registered mortgage over your house. The equity you can release is determined by your age and the property’s value. Loan to value ratios (LVRs) typically range from 15% to 50%, depending on age brackets from 60 to 90 years.

With a Reverse Mortgage, no regular repayments are required, and the loan, including all interest and fees owed, is repaid to the lender when you sell the property, move into aged care, or the last surviving borrower passes away (if you’re part of a couple).

The interest rate is variable, meaning it will fluctuate over time. However, you retain full ownership and can stay in your home as long as you wish. Importantly, Reverse Mortgages are among the most heavily regulated credit products in Australia, with a ‘no negative equity guarantee’ enshrined in law and mandatory independent legal advice required.

For more detailed information download our free Reverse Mortgage guide.

You Don’t Have to Struggle Alone

If you find yourself in a tough financial situation, don’t delay seeking help. Early intervention can provide more options and prevent further complications down the line. It’s also crucial to have open discussions with your family. Most grown children understand the challenges their parents face and can be very supportive during this process.

Before taking out a Reverse Mortgage, make sure you have a thorough understanding of how it works. The amount of interest you’ll pay depends on the funds you draw, and interest only accumulates on these drawn amounts. Also, remember that while your loan amount increases over time due to interest, typically, so does the value of your home.

Also remember that your quality of life is paramount. Are you happy in your current living situation? Does financial stress cloud your days?

You don’t need to live with constant worry. Utilising your home equity through a Reverse Mortgage might be the relief you need to regain control over your finances and, ultimately, your life.

Why Choose Seniors First for Reverse Mortgage

Choosing Seniors First means opting for greater lender choice, ensuring you get a great deal tailored to your specific circumstances:

- Our team works tirelessly to get you the right loan structure, providing insightful tips to save you money.

- We believe in making the loan approval process as easy and stress-free as possible.

- We’re not just fully licensed and qualified; we’re also accredited with lenders, having completed specialised training to offer the best advice and solutions to our clients.

- Beyond our professional qualifications, our team brings a wealth of life experience to the table, along with empathy and understanding for every client’s unique situation.

When it comes to navigating the complexities of Reverse Mortgages and debt consolidation, Seniors First is your trusted partner, dedicated to helping you make informed, confident decisions about your financial future.

Disclaimer

The information provided in this blog is intended for general informational purposes only and should not be construed as personal or financial advice.

[…] Related Post: Retiree Debt Trends: Home Equity Release Helps Over 60’s Cope With Soaring Debt […]

[…] Related Post: Retiree Debt Trends: Home Equity Release Helps Over 60’s Cope With Soaring Debt […]

Please call me. I am interested in your service.

Hi Bill,

Thank you for your comment. One of our team members will touch base with you shortly.

Kind Regards,

Seniors First

[…] [ Related Post: Retiree Debt Trends: Home Equity Release Helps Over 60’s Cope With Soaring Debt ] […]