Formerly known as Pension Loan Scheme or PLS, The Home Equity Access Scheme, or HEAS, is a government-backed loan scheme that offers older Australians a financial safety net. It is often referred to as ‘the government Reverse Mortgage’.

Whilst it has elements in common with Reverse Mortgage loans such as compounding interest, it is actually a loan of pension entitlements, and as such is not a regulated credit product.

It aims to help those who are receiving Age Pension by offering a loan of further entitlements, in the way of fortnightly additional payments (or small lump sums). This income stream is generated by borrowing against the equity of their home.

Unlike traditional mortgages, the loan’s repayment is often deferred until the home is sold or the borrower passes away.

Benefits of the ‘Government Reverse Mortgage’ (HEAS)?

One of the biggest benefits of HEAS is its security and simplicity.As a government-backed home equity release scheme, it arguably offers greater ease of use and stability to borrowers compared to some private sector options.

Below are other benefits of HEAS:

- No Tax on equity drawdowns: One of the standout perks of the HEAS is that it allows borrowers to increase their cash flow without worrying about taxes. These home equity drawdowns feel like tax-free ‘income’ and are a significant advantage for pensioners who want to boost their finances.

- Keep Your Home: With the HEAS, borrowers continue to own their homes and live in them. This feature offers a sense of security and comfort, particularly critical during the golden years of retirement.

- Borrowing with Boundaries: The HEAS comes with a No Negative Equity Guarantee, which places a cap on the amount you can borrow. This protective measure discourages over-borrowing and safeguards borrowers from potential financial turmoil down the road.

The Process of Applying for a HEAS Loan

To qualify for the Centrelink HEAS, you must be of Age Pension age, own your home, and meet certain other requirements. Once you are deemed eligible, you need to take the following steps for your application:

1. Eligibility Assessment

The first step in applying for a HEAS loan is checking your eligibility. Under the HEAS rules, all Australians who reach Age Pension age can qualify to take a HEAS loan if they meet ALL of the following criteria:

- Borrower or partner are of Age Pension age

- Borrower or partner meet the residency rules (living in Australia and are a citizen, permanent resident and/or special category visa holder for at least 10 years, which includes five years of continuous residence, or meet the requirements for widows of an Australian resident

- Borrower must be receiving or qualify for Age Pension

- Borrower or partner must provide real estate situated in Australia as loan security

- Borrower should have adequate insurance covering the property offered as security

- Borrower should not have declared bankruptcy or currently subject to a personal insolvency agreement

2. Loan Application Submission

Once your eligibility is confirmed, the next step is to submit your loan application. This process usually involves a home appraisal to ascertain the home’s value and determine the amount of equity you can borrow against.

3. Loan Agreement Review

After submitting your application, the next step is to review the loan agreement in detail. It’s often beneficial to enlist the help of legal or financial advisors during this stage to ensure you fully understand the loan terms.

4. Wait for Approval

Once you have submitted your application, the approval process starts. Note that Services Australia does not specify the duration of the approval process on its official website.

5. Approval and Fund Release

According to reports from clients and colleagues, the approval process can take 2 to 3 months. During this time, the government meticulously reviews the application before releasing the funds.

While this time frame might seem extensive, it is an important part of ensuring the protection and security offered by the Home Equity Access Scheme (HEAS).

Long Waiting Times: A Critical Drawback of HEAS

While the HEAS provides a multitude of benefits, it is not without its challenges. One of the most pressing issues is the long waiting times associated with the approval process.

Based on anecdotal feedback from applicants contacting Seniors First, this can typically span from 2 to 3 months. That’s a lengthy duration, especially when compared to the private sector options. For those seeking immediate financial relief, this waiting period can prove to be a significant hurdle.

The impact of these extended waiting times can be far-reaching. For one, it can cause potential borrowers to endure financial stress while they wait for their loan to be approved.

In cases where the funds are needed urgently—for healthcare costs, home repairs, or for debt consolidation – the delay could exacerbate financial strain and lead to potential hardship. This could force some individuals to seek out other forms of borrowing to meet their immediate needs.

Moreover, the uncertainty associated with the length of the approval process may deter some potential borrowers from pursuing a HEAS loan. The prospect of waiting months for funds could be unappealing compared to the quicker turnarounds offered by private sector Reverse Mortgage lenders.

Another important factor to consider is that many retirees start off with the government Reverse Mortgage scheme because they were enticed by the lower interest rate.

But when their funds run out quicker than they expected, they often turn then seek out a Reverse Mortgage loan through a broker such as Seniors First.

TIP: It then takes up to three months for the government to formally close a HEAS loan facility and remove the charge or caveat so access to new funds from a Reverse Mortgage loan can be very delayed.

Understanding Why HEAS Takes Time

The lengthy approval process for a HEAS loan is partly due to the rigorous checks and balances the government implements to ensure the protection of borrowers.

Since the scheme involves borrowing against one’s home—a major financial asset—the government takes due diligence very seriously. This includes:

- thorough checks of all documentation

- valuation of the home

- comprehensive assessment of the applicant’s financial situation

While these checks contribute to the long wait, they are essential in maintaining the security and stability of the scheme, reducing the risk of over-borrowing and providing greater protections to the borrower.

Balancing the need for security with efficient service delivery is a challenge the government faces with the HEAS.

Reverse Mortgage Loans: A Faster Alternative

Reverse Mortgages are loans provided by regulated private sector financial institutions that allow homeowners to borrow against the equity in their homes.

Similar to HEAS, these loans are designed for older homeowners who want to supplement their income, pay off debt, or finance large expenses without having to sell their homes.

The borrower is not required to make monthly payments towards the loan balance. Instead, the loan, along with accrued interest and fees, is repaid when the homeowner sells the home, moves out permanently, or passes away.

One of the main advantages of private sector Reverse Mortgage loans is their speed.

While the HEAS can take between 2 to 3 months for approval, Reverse Mortgages can often be conditionally approved in as little as 5 to 7 days in many cases.

The faster turnaround time can provide quick relief for those in need of immediate funds, making Reverse Mortgages a desirable option for many.

IMPORTANT: Reverse Mortgage lenders do not allow simultaneous application. You can’t apply for a Reverse Mortgage from the government and private lenders at the same time. If you have already initiated your HEAS loan application and you are interested in pursuing a loan with a Reverse Mortgage lender you will need to close your government transaction first before you can apply for a new one.

To learn more about Reverse Mortgages, call Seniors First on 1300 745 745 or CLICK HERE to check your eligibility.

Benefits and Risks of Reverse Mortgage Loans

The benefits of Reverse Mortgages are quite similar to those of HEAS. Borrowers can receive a lump sum, or a stream of ‘income’ whilst retaining ownership of their home. Just like the HEAS, they are not required to make regular repayments; the debt plus any interest and fees accrued is repaid when the home is sold or the last surviving borrower passes away.

However, it’s important to note the risks that come with these benefits. As these loans are offered by private institutions, they may come with higher interest rates and fees compared to government-backed options.

In rare cases, Reverse Mortgages can also impact a person’s eligibility for certain government benefits, so it’s essential to check with Centrelink before deciding on this option.

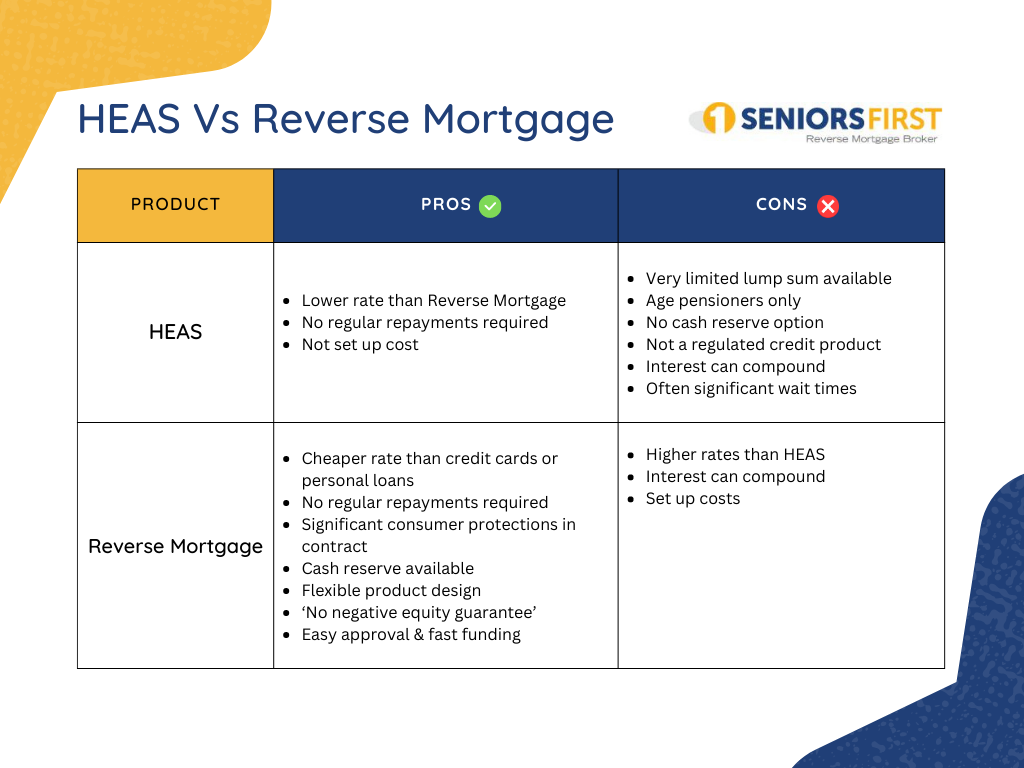

Comparing HEAS and Reverse Mortgage Loans

When comparing the HEAS and private sector Reverse Mortgages, a key trade-off emerges: speed, flexibility versus simplicity and a lower interest rate.

Private Reverse Mortgages tend to offer faster approval and disbursement times. This can be particularly appealing for those needing quick access to funds. They also offer many more loan features and are regulated under the National Consumer Credit Protection (NCCP) code.

(The HEAS is not a credit product and so is not regulated under this code, offering arguably less protection to consumers. However it does feature its own No Negative Equity G’tee)

On the other hand, the HEAS, while slower with its 2 to 3 months approval process, arguably provides a level of security and stability that some private institutions might not offer.

As a government-backed scheme, the HEAS has stringent checks and balances. Although it must be said that Reverse Mortgage lenders also employ very thorough checks, including a compliance call to each borrower and the requirement for independent legal advice (a much higher level of probity than the HEAS)

The quite limited amount of credit available under the HEAS may arguably reduce the risk of over-borrowing and providing an extra layer of protection for borrowers.

DID YOU KNOW: Some retirees don’t prefer HEAS because of the lump sum drawdown limits. Currently the government puts a cap of $13,350 for singles and $20,850 for couples. Up to 2 lump sum advances in any 26 fortnight period are possible, capped at a combined maximum of 50% of the maximum annual rate of Age (including basic pension rate, pension supplement, ES, and RA, where applicable). Refer here for full details.

Choosing Between HEAS and Private Reverse Mortgages: Key Factors to Consider

The choice between a HEAS loan and a private Reverse Mortgage is a significant decision that should be based on personal circumstances, needs, and preferences. Here are a few key factors to consider:

- Urgency of funds: If you need funds immediately, a Reverse Mortgage may be a better option due to its faster approval times.

- Larger loan sizes: the amount of funds you can access via the HEAS is very limited.

- Cash reserve: this is a very popular features with Reverse Mortgages that is not available with the HEAS. It’s a line of credit that allows you to have some equity available for drawdown, but you don’t get charged interest if you don’t use it.

- Security and Stability: If the assurance of a government-backed scheme provides you with peace of mind, the HEAS might be more suitable.

- Impact on government benefits: Borrowing with private Reverse Mortgage lenders could potentially affect eligibility for certain government benefits.

- Interest rates and fees: These tend to be lower with the HEAS than with private sector Reverse Mortgages.

- Advice and Guidance: It’s crucial to seek guidance and advice before deciding. Understanding the nuances and long-term implications of your decision is key to making the choice that best suits your needs.

Remember, whether you choose a HEAS or a private sector Reverse Mortgage, it’s essential to fully understand the terms and potential long-term impacts of the loan.

Consult a Reverse Mortgage Broker & Centrelink Financial Information Services (FIS) Officer

Whether you decide to go with HEAS or a Reverse Mortgage, it’s crucial to make these decisions within the context of:

- your estimated remaining life expectancy at the time of application

- how long you intend to stay in the property

- your broader retirement plan

Navigating the complexities of these financial products often requires expert advice. A licensed, specialist Reverse Mortgage such as Seniors First is well-qualified to provide information and guidance on home equity release options. If you ultimately choose to release cash for equity via a Reverse Mortgage, Seniors First can also manage all aspects of your loan application and approval.

Independent financial advisors or legal counsel can also provide valuable insights and guidance tailored to your personal circumstances.

And if you’re receiving any form of government Age Pension you should consult with a Centrelink Financial Information Services (FIS) officer to check for any possible impact on your entitlements.

Both HEAS and Reverse Mortgage loans can serve as valuable tools in managing your finances during retirement. Ultimately, the right choice will depend on your unique needs, financial situation, and comfort level with potential risks.

Remember, the goal is not just to make a quick decision, but to make an informed decision that will benefit you in the long run. Your home is likely one of your most significant assets, and deciding to borrow against it is a major decision that deserves careful thought and consideration.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.

Hi Darren,

The major issue seems to be not with acquiring a HEAS, but if you want to sell the property to downsize.

Centrelink have advised that the solicitors will *simply* “…. transfer the money.”

“A caveat on the property will remain until the debt is repaid.”

Both the Buyer’s and Seller’s solicitors insist that the caveat MUST be lifted before any monies are transferred or the deposit released.

Talk about a major stressor for my sister.

WHY would anyone put themselves through this????

Hi there and many thanks for the very informative advice. My wife and I are now 71 and 76 years old. After careful consideration plus advice we took our a reverse mortgage with a Bank a couple of years ago It is working well, but my intention was to make a significant payment each month to keep the accrued interest right down. This was fine for a time but some enormous increases in normal living have rendered this impossible now. The Government scheme has an interest rate about 5% less than Gateway. OK, is it allowable under the rules for us to take put the Government loan as well as the Gateway one, simply to receive enough money to pay off the interest on the Gateway loan? It seems that we could still borrow enough money to achieve this (actually any amount will help), and the interest differential of 5% will save us a lot of money over the next 5 years, when we will most likely move to a much smaller house and pay the loans off. I have done the calcs on all this. If we drop dead in the meantime then it doesn't really matter anyway! We have two adult children who will look after the remants of our Estate.

Hi there, glad to hear you have had a positive experience with your Reverse Mortgage lender so far. No I don’t think this is possible at the moment. I believe it was happening for a while, but Centrelink now inform the lender and seek permission. The Reverse Mortgage bank would have to consent for Centrelink to place a caveat on the home (behind the bank’s 1st mortgage) for the HEAS. Most existing Reverse Mortgage lenders are very unlikely to do this because it would weaken their security position by adding to the total debt load againt the home. Regards, DM

We currently have a line of credit attached to our private home. Is it possible to take out a lump sum reverse mortgage to reduce the amount of the line of credit.

Our home is valued as approx. $1m. Line of credit is $350k.

Hi Mary, yes this may be possible to Reverse Mortgage but it will depend on your age. We will have one of our team contact you directly to discuss. Thanks, DM

I think your information is incorrect as there is a $500 establishment fee for HEAS

Hi Jim, there is ZERO formal establishment fee applicable when applying for the HEAS directly with Centrelink. See this guide for details. In some cases Centrelink may charge some time-based fees and legal fees, perhaps this is what you are referring to? It is also possible to apply for the HEAS through some other private organisations. These groups DO charge an establishment fee of around $500 – $600 to provide ‘application assistance’ which some people say is a faster, smoother way to apply.

Thanks Jacqueline for the comment. I think you are referring to the fortnightly payment option, when (in the section you quoted) we were referring to the lump sum option. We have amended the text to make it clearer and have linked to the DSS guide for even further clarity. Best regards.

I would like to apply for reverse home loan thru centrelink i receive a pension and work limited hours

Hi Elizabeth, if you want the Centrelink HEAS we can’t help with that unfortunately. You will need to contact Centrelink directly. Regards, DM

is my existing reverse mortgage scheme variable interest

Hi Stanley, we can’t answer your question in a public forum such as this comment. Please call in on 1300 745 745 to speak with one of our team and we will be happy to assist you. Best regards, DM

[…] borrow from family, or leverage ‘buy now, pay later’ schemes. Others opt for the Home Equity Access Scheme (HEAS) for amounts under $20,000 or seek advice from a financial […]

An obvious drawback is that anything associated with Centrelink cannot be trusted. The lack of respect and their use of dodgy valuations is a red flag to not considering the equity release associated with them.

Many thanks for sending me these comparisons.

I sent in an application to Centrelink for the HEAS on 17 May and am getting very frustrated with them constantly advising that they are working on it – which seems unlikely!

I requested more than I think they will be prepared to advance me, thinking I would do several renovations which I can down scale, but there is no way to change that figure – its either cancel or not, and to change the figure by putting in another application would mean another two or three months!!!

I am still debating whether to apply for a Reverse Mortgage and cancel the HEAS application with them taking so long – and the longer it takes, the more likely that is to happen.

Hi Donelle

Many thanks for leaving a comment. If you do wish to discuss a reverse mortgage with us, please give us a call on 1300 745 745

Seniors First

Beware of tying yourself up with Centrelink and a long term association.

Hi,

I believe there is another difference between the HEAS loan and a commercial reverse mortgage.

Under the HEAS scheme your borrowing calculation includes the net equity left in your house after deducting you current mortgage, So if your house is valued at say $700,000 and the mortgage you owe is $300,000 then the balance of $400,000 is used to evaluate . If you are on a full couples pension thsi will result in about $1,600 per month for about 9 or 10 years.

If you use the same figures in respect to a commercial reverse mortgage, it is highly unlikely that you will have enough equity to get any loan .

Am I correct?

Thanks Andreas. This may be correct, we will check it out and reply with an update. However it’s important to note that existing Reverse Mortgage lenders operating in the market will not consent to the lien or caveat after their first mortgage. This means that if you have a HEAS loan already and you want to release more equity than the HEAS allows via a new Reverse Mortgage, then generally the incoming Reverse Mortgage lender will need to refinance the HEAS so that they hold first mortgage without a caveat or lien on title.