When you’re retired or approaching retirement, managing your finances with care is more important than ever. For many older Australians, a Reverse Mortgage offers a way to unlock the wealth in their home without having to sell or move. But understanding how a Reverse Mortgage might affect your future financial situation can be tricky.

That’s where a Reverse Mortgage calculator comes in.

Using a calculator helps you see how much you might be able to borrow and how the loan could grow over time. It gives you a clearer picture of your future equity and mortgage balance based on factors like interest rates and property growth—making it easier to decide whether a Reverse Mortgage is right for you.

What is a Reverse Mortgage Calculator?

A Reverse Mortgage calculator is a free online tool that helps you estimate how much you could borrow using the equity in your home, and what the impact of that loan could be over the coming years. It’s especially useful for visualising how interest charges grow over time and how much equity you’ll have left in the future.

At Seniors First, we offer an easy-to-use Reverse Mortgage Calculator designed specifically for Australian seniors. It’s a fast and reliable way to explore your options before speaking to a lender or broker.

✅ Note: For formal applications, our team uses the official ASIC Moneysmart Reverse Mortgage Calculator, which includes detailed projections to comply with responsible lending guidelines. You can also use the Moneysmart calculator yourself if you want a more detailed look.

[ ALSO READ: Can You Lose Your Home with a Reverse Mortgage? ]

What You Can Learn From the Seniors First Reverse Mortgage Calculator

Once you enter your personal details, the calculator will give you a projection of:

- The amount you could borrow

- Your loan balance over time (with interest)

- Estimated future value of your home

- How much home equity you’ll have left

This helps answer important questions like:

- If I borrow $100,000 now, how much will I owe in 5 or 10 years?

- Will my home increase in value fast enough to keep equity?

- How much can I leave behind for my family?

Example Walkthrough (Made Simple)

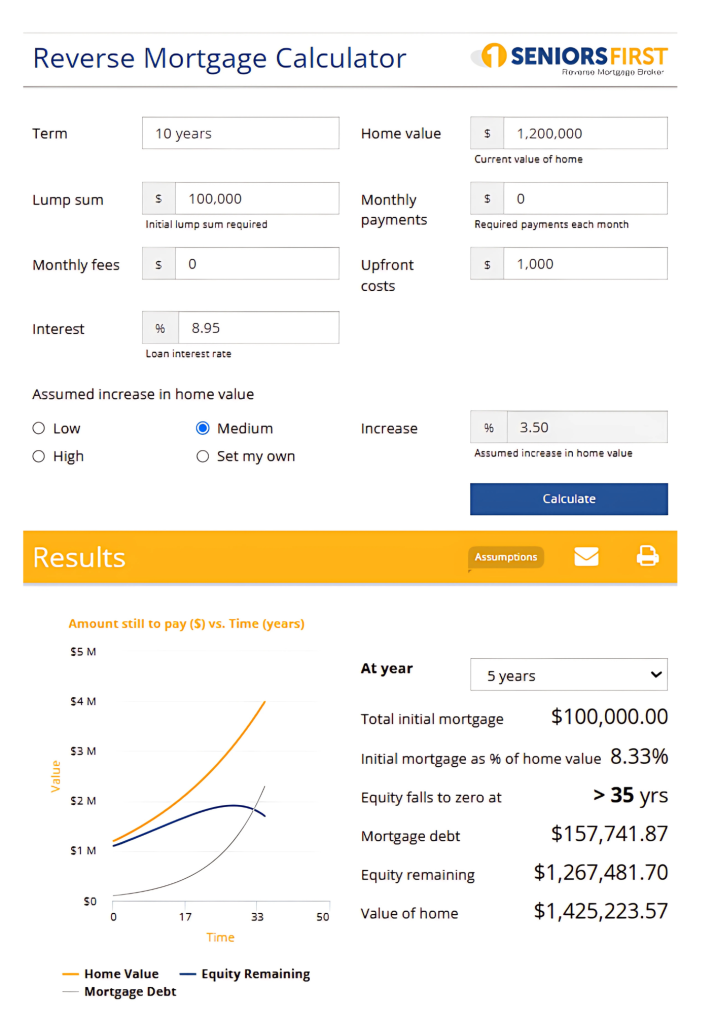

Here’s a real example using the Seniors First Reverse Mortgage Calculator:

Scenario:

- 🏠 Home Value: $1,200,000

- 💵 Lump Sum Borrowed: $100,000

- ⏳ Loan Term: 10 years

- 📈 Interest Rate: 8.95%

- 📊 Expected Home Value Growth: 3.5% annually

- 💸 Upfront Costs: $1,000

- 🧾 Monthly Payments: $0

Result after 5 years:

- 🔹 Mortgage Debt: $157,741.87

- 🔹 Estimated Home Value: $1,425,223.57

- 🔹 Remaining Equity: $1,267,481.70

- 🔹 Equity lasts for: more than 35 years

In simple terms, this shows that even after borrowing $100,000, your home is still expected to grow in value faster than your loan grows. After 5 years, you still have over $1.2 million in equity—a strong safety net.

📈 What the Graph Shows

The chart you see shows how your loan and home value grow over time:

- 🟡 Orange line (Home Value): This increases steadily, showing how your home may grow with time.

- 🔵 Blue line (Equity Remaining): This line shows how much of your home’s value is still yours.

- ⚪ Grey line (Mortgage Debt): This grows slowly as interest builds on your reverse mortgage.

This makes it easy to see that your loan is growing, but your equity is still strong, even in the long term.

What Do You Need to Use the Calculator?

Before you begin, prepare these details:

- Your age (and your partner’s age)

- Current property value

- Loan amount you’d like to borrow

- Expected interest rate

- Assumed growth in your home’s value

- Any monthly repayments you plan to make

If you’re unsure of the interest rate, you can check the Seniors First Reverse Mortgage Interest Rates page for guidance.

[ ALSO READ: High or low: the historical reality of interest rates in Australia ]

Why It’s Just a Starting Point

While the calculator gives a helpful overview, it’s important to remember that these are only estimates, not guarantees. Real-life factors like changing interest rates, different property market conditions, and personal expenses can affect your results.

That’s why we recommend:

✅ Always speak to a Reverse Mortgage expert or financial adviser before making any decisions.

Try It Yourself Today

The Seniors First Reverse Mortgage Calculator is free to use and takes just a few minutes. Whether you’re simply exploring or actively considering a Reverse Mortgage, it’s a great way to see how it might work for you.

Or if you prefer a deeper dive, you can also use the official ASIC Moneysmart Reverse Mortgage Calculator for detailed planning.

A Reverse Mortgage can be a helpful financial tool to improve your lifestyle, cover unexpected costs, or help your family—without giving up your home. But like any major financial decision, it’s best made with good information and a clear understanding of the long-term impacts.

By using a Reverse Mortgage calculator, you’re taking the first step toward informed decision-making.

Need help or have questions?

📞 Call Seniors First on 1300 745 745

💻 Or visit seniorsfirst.com.au to get started.