There’s a growing trend among Australian retirees that’s hard to ignore: an increasing number are looking towards the government’s Reverse Mortgage scheme, known as the Home Equity Access Scheme, to supplement their retirement income.

This isn’t a small shift; it’s a significant movement, with the number of participants soaring at an impressive annual rate of about 60%.

In concrete numbers, the Department of Social Services reported a jump from 6041 participants in June 2022 to a notable 9750 in June 2023 – an increase of 61% in just 12 months. This increase isn’t just in participant numbers; it’s also in the value of the funds being utilized. In June 2023, retirees had drawn a substantial $240 million from the scheme, a significant rise from $138 million just a year before.

For those of you pondering over your retirement financial strategy, these figures represent an important trend to consider. Let’s look into why this Reverse Mortgage scheme is becoming a popular choice and how it could potentially enhance your financial comfort in retirement.

What are Reverse Mortgages?

Have you ever wondered about tapping into the wealth tied up in your home without having to sell it? That’s where Reverse Mortgages come into play. In simple terms, a Reverse Mortgage allows you as a retiree to borrow money against the value of your home. You can choose to receive this as a lump sum, regular income stream, or a line of credit. The beauty of it? You continue living in your home while accessing these funds.

Now, let’s talk about the Australian government’s unique take on this – the Home Equity Access Scheme. This scheme is tailored specifically for retirees like you, offering a secure way to supplement your income using the equity in your home.

The government’s scheme caps the amount you can borrow, ensuring the loan won’t exceed a certain percentage of your home’s value over time. This means less worry about the debt overtaking the value of your home.

Understanding Reverse Mortgages, especially the government’s scheme, could open doors to financial flexibility in your retirement.

Benefits and Risks of Reverse Mortgages

When you’re considering a Reverse Mortgage, it’s crucial to weigh up the pros and cons. Let’s break them down, so you can make an informed decision:

Benefits

- Income Boost: A Reverse Mortgage can significantly augment your income, especially useful if you’re on a pension. Imagine having extra funds for your day-to-day needs or even fulfilling a long-held dream.

- Flexibility: You get to choose how you receive the funds – be it a lump sum, regular payments, or a line of credit. This flexibility allows you to plan your finances in a way that best suits your lifestyle.

- Stay in Your Home: One of the biggest perks is that you can continue living in your home while accessing its equity. This means maintaining your lifestyle and staying in familiar surroundings.

Risks

- Interest Compounding: The interest on a Reverse Mortgage compounds over time, which means the amount you owe can grow quickly. It’s crucial to understand how this affects the equity in your home.

- Reduced Equity for Future Needs: You also need to consider the potential reduction in home equity. This could impact your ability to fund aged care or leave an inheritance.

- Complexity and Costs: Reverse Mortgages can be complex financial products. There are fees and charges involved, and the long-term financial implications can be significant.

[ Related Post: The Ultimate List of Reverse Mortgage Pros and Cons, Australia [2023] ]

Understanding both sides of the coin is key when exploring Reverse Mortgages. It’s about balancing the immediate financial relief they offer with the long-term impact on your home’s equity.

Comparing Government and Private Reverse Mortgages

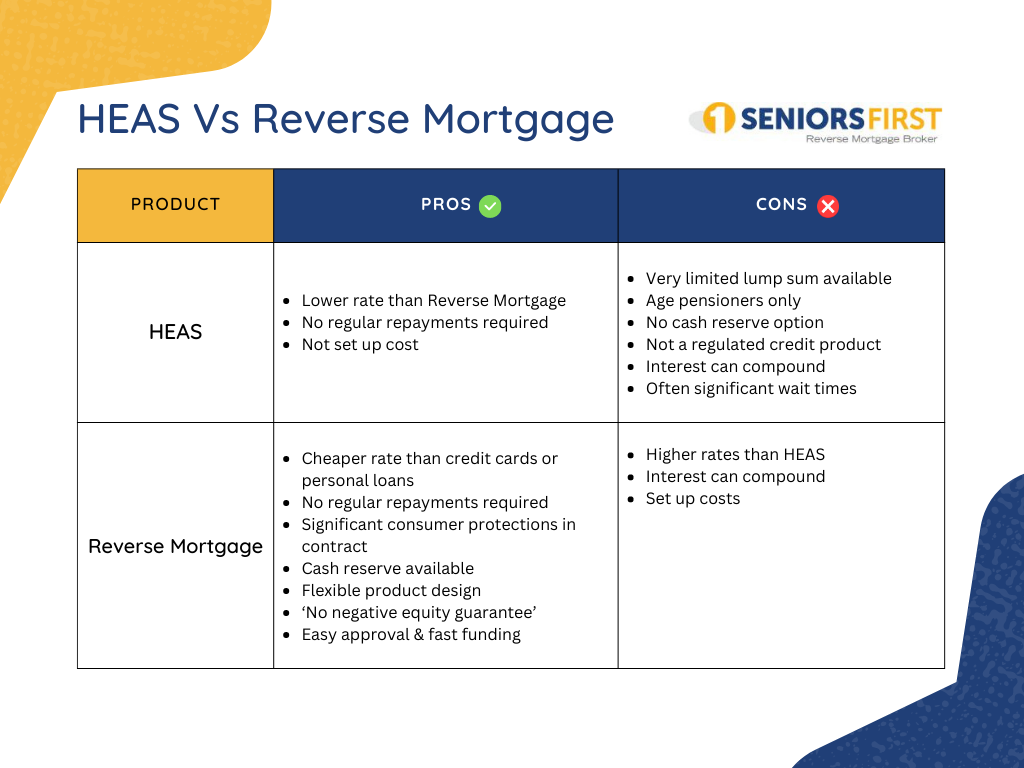

Choosing between a government or private Reverse Mortgage is a crucial decision for retirees in Australia. Each option has its unique features, and understanding these can guide you to the best choice for your situation. Here’s a closer look at how they differ:

Despite the additional costs, private Reverse Mortgages could still be the right choice for some retirees. They may offer more substantial loan amounts or more tailored payment plans, which can be crucial for those with specific financial goals or needs.

It’s about balancing the immediate benefits with the long-term implications, and for some, the flexibility and potential for larger loans provided by private schemes can align better with their retirement plans.

Your choice depends on what you value most: the security and lower costs of government schemes, or the greater flexibility and potentially larger loans from private providers. Understanding these nuances will help you make an informed decision that fits your retirement vision.

[ Related Post: Centrelink Home Equity Access Scheme (HEAS) vs Reverse Mortgage Loans ]

Click HERE to learn more about Reverse Mortgages or call Seniors First on 1300 745 745.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.

Hi,

Question for a client ( and my Mum ) . She has a property in a retirement Village . Owns unencumbered other than the sale agreement of shared capital growth arrangement. Can this security be used for a reverse Mortgage

Hi Scott, thanks for the question. We get this one a lot, but regrettably it’s not posssible to get a reverse mortgage loan against aa retirement village unit. Lenders will not accept them as security becaue of the DMF. Regards, DM