I’m pleased to announce that in 2026 Seniors First proudly marks 20 years of helping older Australians access home equity safely, responsibly, and with confidence. Somehow, we have become the oldest continuing brand in Australian Reverse Mortgages!

Looking back on the history of the industry, Reverse Mortgages were far less understood when I founded the company in 2006. Public awareness was limited, regulation was still developing, and many older Australians were unsure whether accessing home equity could be done safely.

Since then, Australia’s retirement landscape has changed dramatically:

- Australians are living longer, healthier lives

- Home ownership among retirees remains high

- Superannuation balances are often insufficient to fund longer retirements

- Cost-of-living pressures and healthcare expenses continue to rise

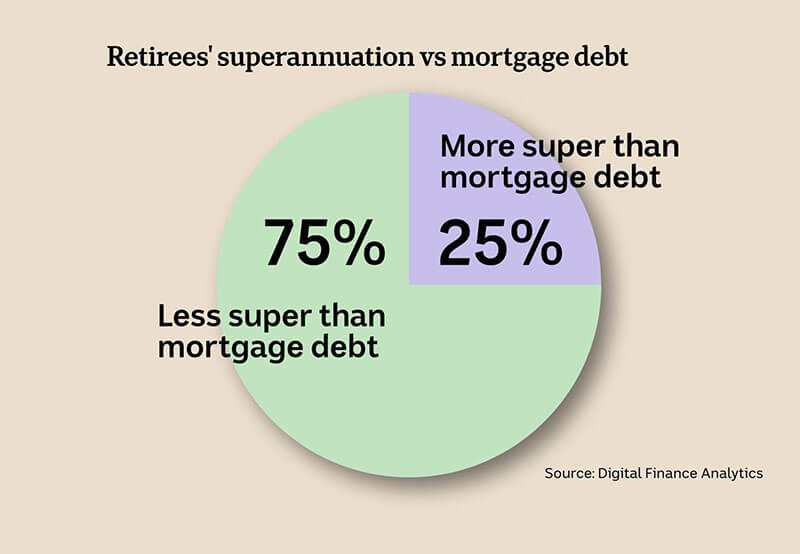

- Record numbers of Australians are retiring with debt

Today, Australia’s over-55 population is growing rapidly, and household wealth is increasingly concentrated in residential property. Estimates consistently show that housing equity represents the largest store of wealth for older Australians, often exceeding superannuation by a significant margin.

Against this backdrop, Reverse Mortgages have become less about luxury and more about supplementing Age Pension, financial resilience, ageing in place, and maintaining independence.

This milestone is a chance to reflect on what experience delivers and why the role of specialist brokers matters, as Australia’s demographic and economic landscape evolves.

Home Equity Release Industry Leadership

I’d like to pay tribute to all the wonderful staff (past and present) who’ve been part of the Seniors First story. The team and I have spent 20 years at the forefront of Reverse Mortgage lending in Australia, advocating for higher standards, better education, and responsible use of equity release.

That long-term perspective — combined with rigorous training, ethical standards, and client-first advocacy — has positioned Seniors First as a trusted guide for both homeowners and industry partners.

We are perhaps the only mortgage broker group in Australia who for two decades has consistently encouraged people to borrow less. Since our inception in 2006, we have counseled older borrowers on the importance of drawing less money upfront, to instead draw down funds gradually over time wherever possible (such an approach is the most effective way for borrowers to minimise interest costs and preserve more home equity).

This pre-dated Best Interest Duty (BID) regulation by some 15 years.

Here’s a short list of our key achievements:

- #1 in the category of specialist Reverse Mortgage broker

- Helped more than 6,000 Australians release home equity

- Received 480 five-star reviews from happy customers

- 30,000+ downloads of our famous free guide, Reverse Mortgage Secrets

- Saved borrowers thousands of dollars in interest costs

- Pioneered industry-best loan structuring, with Home Equisaver™ method

- Established the largest specialist Reverse Mortgage lender panel in Australia (an achievement jointly shared with a respected competitor)

- Selected as launch partner for numerous new Reverse Mortgage lenders – helping to launch products, guide policy and product development

The Seniors First team in 2026

How Australia’s Population and Wealth Landscape Is Changing

Ageing Population

The rapid growth Seniors First has enjoyed over recent years is partly a function of the demographic and macroeconomic changes that are reshaping Australia.

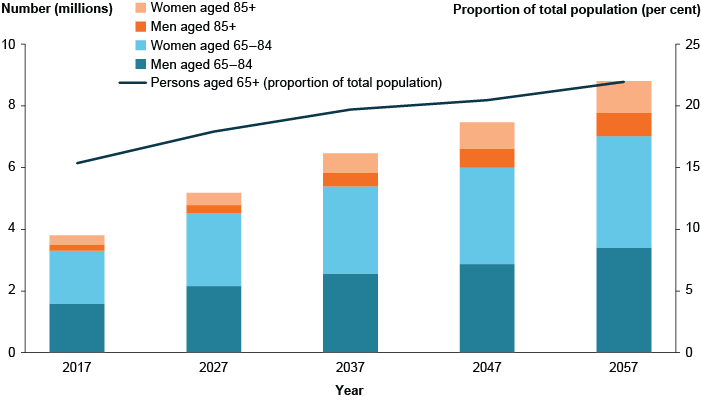

Australia’s population is ageing rapidly. By the mid-2030s, more than 20% of Australians will be aged over 65 — a demographic shift that will continue through to 2060. According to the Intergenerational report, older population segments are projected to more than double in number, with those aged 85+ expected to triple over the next 40 years.

Growth in Retiree Numbers

Over the next decade alone, roughly 2.5 million Australians are expected to transition from the workforce into retirement — putting additional pressure on retirement funding systems and household cash flow.

Home Ownership and Wealth Distribution for Older Australians

Housing Wealth Remains Central

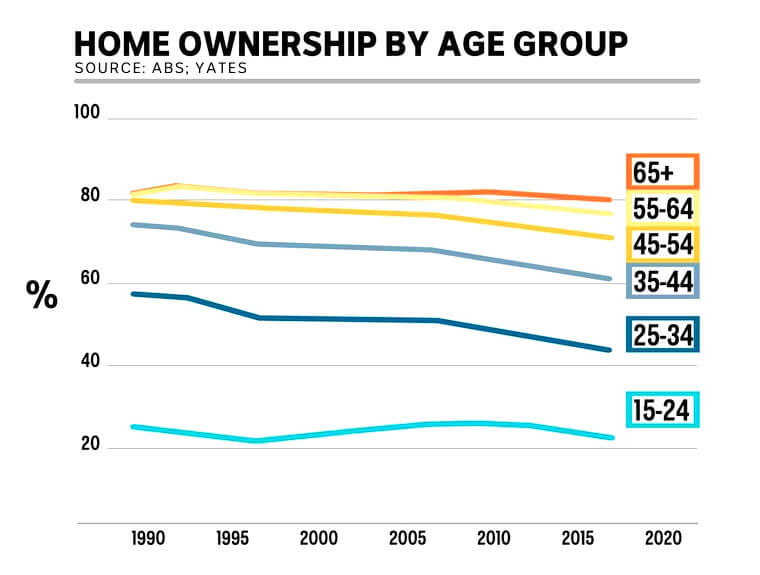

Housing remains the cornerstone of wealth for older Australians:

- According to the HILDA survey, homeowners aged 65+ often hold the majority of their wealth in housing rather than superannuation or other financial assets.

- Recent estimates suggest that Australian households aged 65+ hold around $3 trillion in housing wealth, a major source of untapped economic security. (Morningstar)

Outright Home Ownership Trends

While many retirees still own their homes outright, outright ownership has declined over the last two decades. For example, the number of 55–64-year-olds owning homes free of mortgage has almost halved over 20 years, increasing the number who enter retirement with housing debt.

This is what I have called the ‘new epidemic’. It is due to a systemic failing of Governments and public policy makers over the last three decades, and is a tragedy for the individuals affected.

Asset Rich, Cash Poor Patterns

Research shows many retirees are “asset rich but income poor”:

- More than 80% of people aged 65–74 still live in their own home, but often rely on limited cash flow. (Money Management)

According to the Actuaries Institute Report, More Than Just a Roof, if retirees accessed even 20% of the estimated $1.3 trillion in home equity held by older Australians, it could potentially unlock hundreds of billions for retirement income purposes.

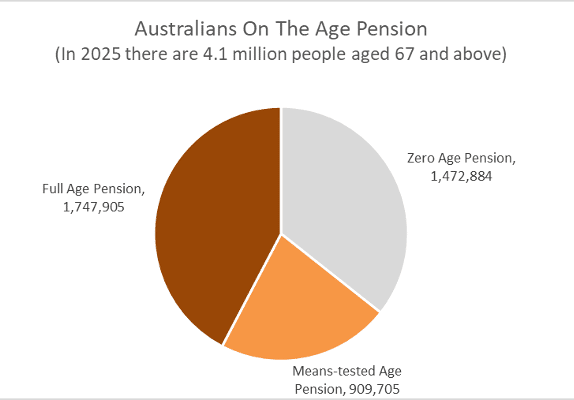

Income Realities in Retirement

Despite substantial asset holdings, many older Australians have limited regular income:

- Among people aged 65–74, nearly half rely primarily on government pensions as their main source of income, with superannuation providing a smaller share. (AIHW)

These patterns reinforce why homeowners may seek alternatives — such as equity release — to improve income security while staying in their homes.

Reverse Mortgage Market: Awareness and Potential

Awareness vs Understanding

While many older Australians have heard of Reverse Mortgages, until recently there was a limited understanding of home equity release in the community.

This began to change in 2022 when the Federal Government announced a relaunch of the old Pension Loans Scheme as the Home Equity Access Scheme (HEAS). The HEAS is often referred to as the ‘Government Reverse Mortgage’, and this has had the effect of lifting awareness of how equity release works amongst age pensioners and retirees.

The fact that the Government is providing a similar product, has largely removed any remaining stigma that was once attached to commercially provided Reverse Mortgage loans. In fact, with virtually no promotion the HEAS has grown so fast that the Department has struggled to sufficiently resource it, and extremely long wait times are not uncommon.

Market Size Context

Exact current figures for total Reverse Mortgage balances in Australia are difficult to publish (no central industry body routinely reports a national Reverse Mortgage book). However the growth of the HEAS is a good proxy for the wider equity release industry:

- In 2024 the government-funded HEAS (formerly Pension Loans Scheme) had over 12,000 participants, a significant increase from around 6,000–9,700 in 2023, representing a 329% surge since the pandemic.

In another sign that industry is responding to increased consumer demand:

- Two new lenders entered the market in the years 2020 to 2025, but a further additional two new lenders have already launched in 2026

However, given the growth in housing wealth and retiree numbers the category remains relatively small compared to the opportunity represented by untapped home equity.

Reverse Mortgage borrower types

In recent times Seniors First have identified five core types of Reverse Mortgage borrowers. This matrix is a useful schema for understanding in the Australian market in 2026

| Type | Characteristics | Key Objective |

| “The cash limited” |

|

|

| “The debt-busters” |

|

|

| “The lifestylers” |

|

|

| “The home-lovers” |

|

|

| “The future downsizers” |

|

|

Reverse Mortgages can be a ‘lifesaver’ – a customer story I’ll never forget…

When it comes to releasing home equity there are some common Reverse Mortgage loan purposes that we see everyday:

- Supplementing retirement income for living expenses

- Funding home maintenance or renovations

- Debt consolidation and home loan refinance

- Creating a financial buffer for future certainty

- Buying a new motor vehicle

- Travel and holidays

- Supporting family members

Sometimes people also use Reverse Mortgages for medical expenses, and there’s one story in particular that stands out.

In 2022 we established a Reverse Mortgage for a Sydney customer who wanted a modest lump sum for his immediate needs, and a cash reserve (which doesn’t attract interest cost unless it is used) for any future emergencies that might emerge.

Unfortunately for him, a serious emergency did arise: he was diagnosed with cancer a few years later. He was then horrified to discover there was a six month wait for the treatment he needed in the public health system. Deeply worried for his health and even his prospects for survival, he decided to draw on the cash reserve to bypass the waiting list and fund immediate treatment with elective surgery.

Thankfully his treatment was successful, and he’s made a full recovery. To this day, he credits his Seniors First Reverse Mortgage loan with probably saving his life.

Learnings From 20 Years in the Reverse Mortgage Industry

As I reflect on the Seniors First journey so far, I think it’s worth sharing a few thoughts on the Reverse Mortgage market.

1. Specialist training for mortgage brokers is essential

Reverse Mortgage loans are unique and work very differently from standard home loans. In addition, the typical (older) borrower profile is unfamiliar to the average mortgage broker; they are less attuned to the common challenges of ageing. Equity release also sometimes triggers intense feelings from adult children, especially in blended families. Brokers who work in the Reverse Mortgage space need:

- a higher level emotional intelligence (EQ) and sensitivity

- superior patience, care, and understanding of intra-family dynamics

- a sophisticated knowledge of the math behind home equity release ie; compounding interest effect and its relationship with home equity

This is why Seniors First has developed the most extensive, in-house Reverse Mortgage training program in Australia. In addition to the FBAA Seniors Equity Release course, all of our brokers undertake this program, which goes far beyond the minimum lenders accreditation requirements. This includes:

- 56 hours of broker training on on product, policy and process

- Pension, aged-care, cash flow and estate considerations

- Advanced loan structuring techniques such as the HomeEquiSaver™ method (designed to minimise cost and preserve home equity)

It’s my firm view that Reverse Mortgages are not a product that should be offered by mortgage brokers without (at least) completion of the FBAA Equity Release course. To any potential Reverse Mortgage borrowers reading this, if you’re not intending to use Seniors First (that’s ok) I recommend you approach some of the other fine specialist brokers in the market (rather than just a generalist mortgage broker).

2. The right lender partners make all the difference

Over the years we have been fortunate to partner with some really great banks and lenders. We are always careful about who we add to our panel, and each lender that approaches us undergoes a vetting process. Seniors First has actually declined approaches from some lenders because they do not meet our criteria of fair contract terms, reliable customer service, and strong compliance processes.

In this way, both our customers and our broker team can feel confident that the company is putting the best interests of borrowers above any commercial considerations.

3. Control and flexibility in product design is paramount

People aged over 55 years have typically led a full life and appreciate lenders who give them agency to make their own decisions (whilst also ensuring appropriate safeguards and protections are in place).

In customer surveys our borrowers are very clear on what they want in a Reverse Mortgage product. Time and time again they’ve told us that after a competitive interest rate, the two most important aspects are ‘flexibility’ and ‘control’.

4. Over 55’s appreciate a digital experience.

The team at Seniors First have observed that digital literacy amongst over 60’s has skyrocketed in recent years. The data backs this up, with reports finding that digital literacy among Australian seniors is improving, with 78-93% of older Australians now using the internet.

Since 2023, Seniors First has invested heavily in technology. We now offer a market-leading digital Reverse Mortgage experience with enhanced speed to funding. Our systems can reduce loan approval and settlement timelines by several weeks.

5. Borrowers want an advocate who can unlock value

These days it’s increasingly unlikely for a borrower to go ‘direct to lender’. Homeowners know their interests are better served by going through a mortgage broker who offers the choice (and convenience) of many different banks & lenders in one place. It’s no wonder that brokers now account for 78 per cent of all mortgages originated in Australia.

The argument for using a broker for Reverse Mortgage loans is even more compelling. Seniors First recently conducted research which identified 150 points of difference among just the top four lenders, across product features, eligibility criteria, and post settlement loan procedures. This is a stark illustration of just how complex this market is, and why specialist brokers are dominating this market.

A defining feature of the Seniors First model is acting as the client’s advocate to the lenders:

- Comparing multiple products for suitability

- Accessing broker-only interest rates and negotiating potential discounts

- Navigating lender credit policies and advocating for loan approval on the client’s behalf

- Clarifying complex features and implications before decisions are made

This client advocacy approach improves the confidence in borrowers that they’ll get a good outcome.

Looking Ahead: The Future of Home Equity Release

Thank you for reading this rather long essay; I hope you agree a 20 year anniversary justifies such an indulgence.

I’d like to extend a BIG thank you to our lender partners, suppliers, and everyone who’s made a contribution over the last two decades.

If you’re an existing customer, or a borrower who has used our service previously, thank you for the support. The team and I appreciate your trust, and we never take it for granted. Like any organisation, we are not perfect. But we do always seek to learn from any mistakes, and a large part of our story is a commitment to ongoing improvement.

Looking ahead to the future, I predict equity release will become an even more significant part of Australia’s retirement landscape. The value of specialist broker training, client advocacy, and long-term thinking will be increasingly evident as four ‘mega trends’ continue to impact the market:

- An ageing population with increased longevity

- Rising numbers of retirees carrying mortgage debt

- Significant untapped housing wealth that could support retirement living

- Continued interest among older Australians in ageing in place, rather than downsizing

As these pressures evolve, so too will the need for experienced, specialist Reverse Mortgage brokers to help older homeowners navigate the complex trade-offs involved. (I’d encourage any brokers who are looking to specialise in Reverse Mortgages to reach out – we’re always looking for good people to join our team).

Finally, as we enter our third decade the founding mission of Seniors First will remain unchanged: to help older Australians live well at home, with dignity, choice, and confidence.

Regards, Darren

Very informative and yes you are entitled to pat yourself and of course your team, on the back for 20 successful years of assistance to older Australians, (not sure I like that title,lol), and hope the next 20 are even better.

Thank you James! That is very kind. Cheers, Darren