As foreshadowed in our last post, the much awaited ASIC Reverse Mortgage Report was released today. This is an important document for all key stakeholders who comprise the Australian Reverse Mortgage ecosystem:

- Seniors / reverse mortgage borrowers

- Reverse Mortgage Lenders

- Reverse Mortgage Brokers

- Regulators

- Solicitors

- Financial advisers

- Family members of borrowers

- Centrelink

- Government

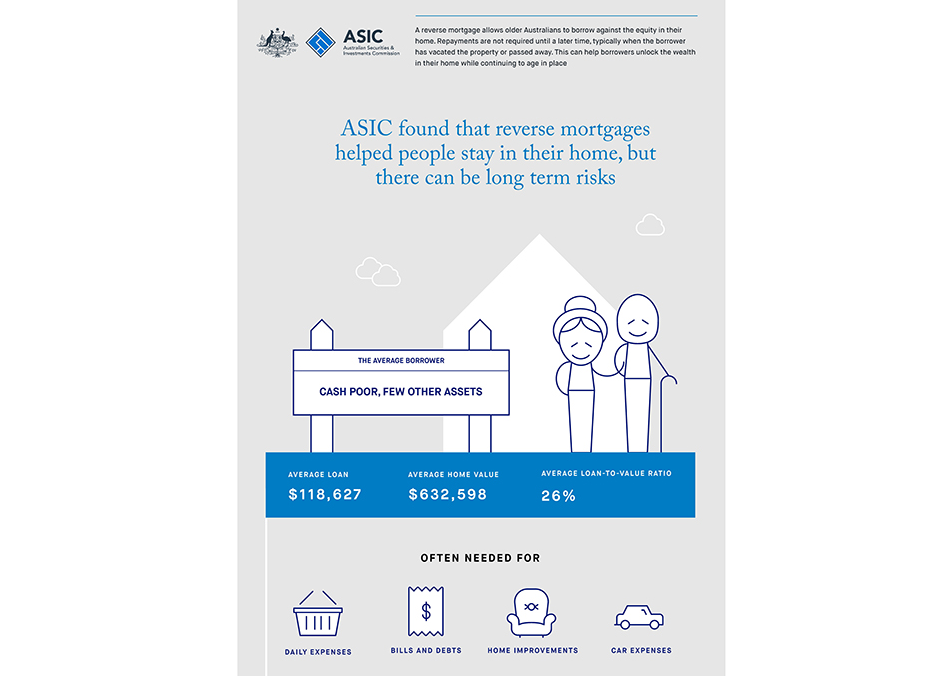

I am still reviewing the findings of the report in detail, but some of the early key findings of the report are:

1. The Reverse Mortgage credit market needs more supply.

ASIC has rightly identified that the reverse mortgage lending market is highly concentrated. More lenders are required to mitigate supply-side risk and offer more choice and product innovation to senior consumers. There is a perceived lack of alternatives to Reverse Mortgages available for seniors who want to release home equity.

2. Reverse Mortgages meet the ‘immediate objectives’ of borrowers effectively

ASIC interviewed 30 reverse mortgage borrowers as part of its consumer research. It found that the reverse mortgage enabled borrowers to:

(a) maintain their current living arrangements without continuing to

experience financial stress;

(b) afford a better quality of life;

(c) obtain short-term finance; or

(d) have a general safety net for living expenses:

3. Elder abuse is an area to watch.

Although reported incidents of elder abuse connected with Reverse Mortgage loans appears low, ASIC are nevertheless right to be vigilant for potential future issues. They are proposing some further safeguards in this area.

4. Reverse Mortgage Lenders can do more to educate borrowers on long-term risks.

More work needs to be done by reverse mortgage lenders and brokers to ensure that that borrowers are fully cognisant of possible long-term risks. Some terms in Reverse Mortgage loan contracts were also fund to be potentially “unfair”. Here is the ASIC infographic:

For the full report go HERE.

I will come back with some commentary on the report soon. If you have any questions about this, or what it means for you, please leave a comment below.

Regards, Darren