How do Reverse

Mortgages work?

FREE Reverse Mortgage Australia guide from Seniors First. 30,000+ downloads since its first edition in 2008.

How Reverse Mortgage Works in Australia

A Reverse Mortgage is a loan designed for Australian homeowners aged 55 and over. It lets you unlock equity from your home without selling or moving. Unlike a standard mortgage, you don’t make monthly repayments. Instead, the amount borrowed plus any accrued interest and fees are repaid when you sell your home, move permanently into aged care, or pass away.

This can provide a much-needed financial buffer in retirement to cover living costs, medical expenses, home improvements, or even just peace of mind.

Table of Contents

What is a Reverse Mortgage? (Simple Definition)

Reverse Mortgage is a type of loan where you borrow against the value of your home. You remain the legal owner and can stay in the property for life, provided you meet basic obligations like paying council rates, home insurance, and maintaining the property.

Key takeaway

You don’t need to make regular repayments on Reverse Mortgages. The loan plus any accrued interest and fees is paid back when the property is eventually sold.

Eligibility and Borrowing Limits

Reverse Mortgages are only available if:

Borrowing Limits by Age

The amount you can borrow increases as you age.

Example: On a $900,000 home, a 65-year-old might access $180,000, while a 75-year-old may access $270,000.

Common Loan Purposes

Many Australian seniors use a Reverse Mortgage to improve quality of life in retirement.

The funds are flexible and can be used for almost anything, but the most common purposes include:

Supplementing retirement income

Covering everyday bills and living expenses, or for "life's little luxuries".

Debt repayment

Clearing mortgages, credit cards, or personal

loans to reduce financial stress.

Medical and aged care costs

Paying for in-home support, equipment, or aged care accommodation.

Family support

Gifting money to children or grandchildren, such as helping with education or a house deposit.

Home improvements

Upgrading kitchens, bathrooms, or making the home more accessible (ramps, rails, modifications).

Lifestyle and travel

Enjoying retirement by funding the purchase of a new car, holidays or hobbies.

Key takeaway

A Reverse Mortgage can provide financial freedom now, but always consider how borrowing now may reduce future options.

How You Can Receive the Funds

Reverse Mortgage loans offer flexibility in how you can draw down the money:

Lenders can provide you a lump sum money at the start of your loan. Policies between lenders vary, but some have a minimum drawdown for this option of $10,000, unless you are planning to use the money for in-home aged care. On top of the lump sum, you can receive the proceeds as needed through the other available options.

PERFECT FOR: This option is ideal for debt consolidation, home loan refinance, home renovation, new car purchase, medical expenses.

Receiving regular advances is ideal if you are planning to draw on your loan gradually, to supplement your retirement income. This option will allow you to set a regular drawdown payment (monthly, quarterly, or yearly) for up to 10 years.

The regular amount you receive feels like 'income' but it is actually a small portion of your home equity. You can set the amount you receive from hundreds, to thousands of dollars each month. The limit is determined by the value of your home, your age and the term schedule.

PERFECT FOR: ‘topping up’ the Age Pension or limited retirement income to better cover living expenses, or for home care costs.

You can unlock your home equity to set up a cash reserve that you can easily access anytime you want. The good thing about this option is that you will only pay interest on the cash drawn, as you draw it down.

Depending on the lender, there may be no minimum drawdown amount on a cash reserve facility. Some lenders even allow you to access this money directly by debit card at ATM's.

PERFECT FOR: ‘rainy day’ funds for emergencies and unexpected expenses, or occasional special treats such as holidays.

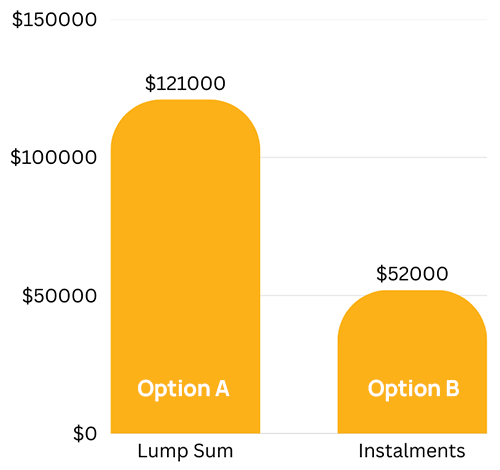

A combination reverse mortgage is very popular. About 8 in 10 Seniors First customers choose some form of combination of lump sum, cash reserve or income stream for their reverse mortgage loan structure.

According to a Seniors First survey in 2024, 77 per cent of Reverse Mortgage borrowers rate the importance of a cash reserve option as 'very high' in their choice of lender.

No Regular Repayments: How It Really Works

One of the biggest advantages of a Reverse Mortgage is that no regular repayments are required.

Key takeaway

“No repayments” does not mean the loan is free. The debt grows over time due to compound interest (unless you pay monthly interest).

How Interest Calculation Works (Compounding Effect)

Interest on a Reverse Mortgage is calculated daily and 'capitalised', which means the monthly interest charge is added onto the existing loan balance. Over time, this causes the balance to grow faster than with a traditional loan.

The biggest drawback of Reverse Mortgages is the compounding interest, which reduces the equity in your home over time. However, it’s important to understand that the home value should also compound over time, and that future capital gains on property may partly, or fully, offset interest costs. CoreLogic reports that Australian home values surged 39.1% in the five years to 2025, representing an increase in the average home value of $230,000.

How to save interest:

Reverse Mortgage Golden Rule

It’s little known that borrowers can enjoy very substantial interest savings on Reverse Mortgage loans by structuring the loan in certain ways.

In fact, there is what we call the "Reverse Mortgage Golden Rule": draw as much of the loan as possible, gradually over time (instead of as an upfront lump sum).

This principle is the foundation for our Home EquiSaver™ method, exclusive to Seniors First.

Home EquiSaver™ is the approach Seniors First brokers use to find the optimal loan structure for each borrower in order to achieve two key objectives:

The output of the Home EquiSaver™ method is the Compound Interest Savings Ratio (CISR). This ratio is expressed as a percentage of the total potential interest savings that the loan structure could deliver, compared to the interest cost that would otherwise apply on a full lump sum loan.

The Compound Interest Savings Ratio (CISR) is different for each borrower, depending on the proportion of total loan funds that is taken as an upfront lump sum, versus gradually over time. The higher the ratio, the more interest cost potentially saved - and the more benefit derived from Home EquiSaver™ to the borrower.

To provide the most meaningful results the following assumptions apply:

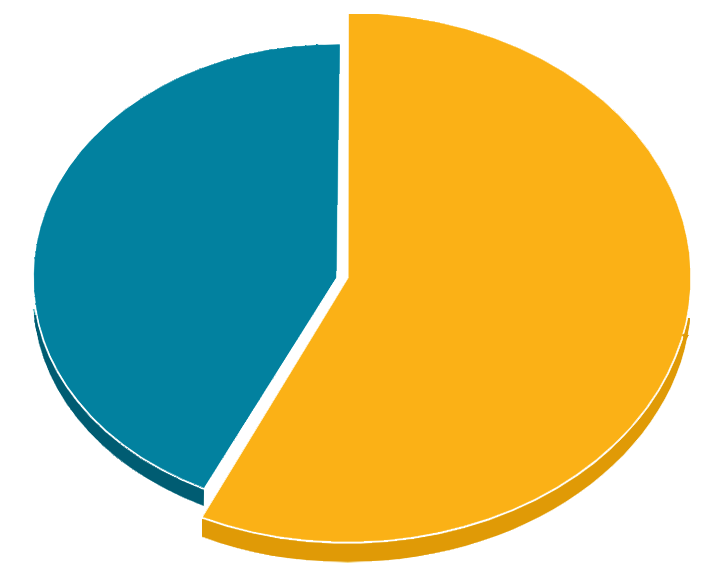

Home EquiSaver™ Example 1:

Total loan facility amount: $100,000

Interest rate: 8% Term: 10 years*

*Most Reverse Mortgages have no set term, this is for illustration purposes only.

Option A: take all funds as upfront lump sum - $121,000 interest cost (over 10 years)

Option B: take all funds as Instalment plan - $52,000 interest cost (over 10 years)

Net interest saving (NIS) with option B: $69,000

Compound Interest Savings Ratio (CISR): 57% in potential savings with this loan structure

Compound Interest Savings Ratio (CISR)

I

57%

SAVED (CISR)

*less interest

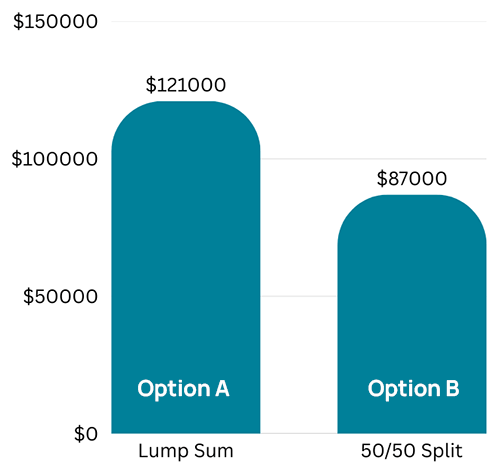

Interest Cost Comparison

(10 years)

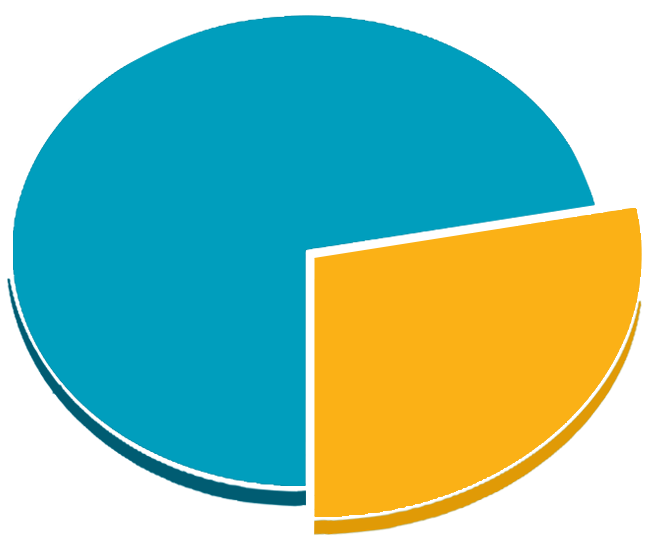

Home EquiSaver™

Example 2:

Total loan facility amount: $100,000

Interest rate: 8% Term: 10 years*

*Most Reverse Mortgages have no set term, this is for illustration purposes only

Option A: take all funds as upfront lump sum - $121,000 interest cost (over 10 years)

Option B: draw $50,000 as a lump sum and $50,000 as instalment plan - $87,000 interest cost (over 10 years)

Net interest saving (NIS) with option B: $34,000

Compound Interest Savings Ratio™ (CISR): 28% in potential savings with this loan structure

Compound Interest Savings Ratio (CISR)

I

28%

SAVED (CISR)

*less interest

Interest Cost Comparison

(10 years)

A specialist Reverse Mortgage broker is best placed to help you get the right loan structure. The Home EquiSaver™ method is exclusive to Seniors First.

Aside from paying the interest charge each month so tha the debt doesn't grow, Home EquiSaver™ is the best way for borrowers to:

USE A BROKER - GET THE RIGHT LOAN STRUCTURE

Enquire with Seniors First to discover your personalised Compound Interest Savings Ratio (CISR) Find out how much the right loan structure can your reduce potential interest cost, with our Home EquiSaver™ method. It’s 100% exclusive to Seniors First.

Impact on Your Estate Value

Because the Reverse Mortgage loan balance typically grows, your estate (what you leave to beneficiaries) may be reduced. For families, this can mean less inheritance.

However, protections exist:

EXPERT TIP:

You can limit any negative impact on the estate value by paying the monthly interest to stop the loan balance growing. Some lenders also have a ‘protected equity feature’ which allows you to effectively quarantine a portion of the home equity for beneficiaries.

Loan Repayment Triggers

A Reverse Mortgage does not require repayments while you live in your home, but it must be repaid when certain events occur;

You sell your home.

You move permanently into aged care (some lenders);

You pass away (the loan is repaid from your estate, usually via sale of the property).

If a surviving spouse is listed as a co-borrower, they can continue living in the home until they also leave or pass away.

Will a Reverse Mortgage Affect My Age Pension?

GOOD NEWS: in the vast majority of cases Reverse Mortgage loans don't affect Age Pension entitlements. However it is possible under some circumstances, depending on how the funds are used. Here are two use cases that are more likely to cause problems:

Every case is different, so it’s always best to check with Centrelink’s Financial Information Service (FIS) before loan approval.

DID YOU KNOW:

The family home (principal place of residence only) is an exempt asset for the Age Pension test. So any Reverse Mortgage loan funds used on repairs or renovation will not impact entitlements.

Protections Under Australian Law

Reverse mortgages are the most highly regulated credit product in Australia.

Reverse Mortgage loans provided through specialist brokers, using recognised lenders, are very safe.

You and your spouse have the right to live in your home for life, as long as you meet the loan conditions.

Lenders generally require you to seek independent legal and/or financial advice before signing. This provides an extra fail-safe check to ensure that you have understood

DID YOU KNOW:

Reverse Mortgage borrowers actually get a higher level of protection by going through a mortgage broker for their loan (as opposed to going direct to a lender). This is because brokers must abide by Best Interest Duty (BID) regulation, introduced in 2021. Lenders themselves do not have to meet this higher standard of customer care.

Risks & Benefits to Consider

Risks

Benefits

Rated 4.9 stars on

“Sincere thanks to Andrew and Seniors First .. the loan has been life changing.”

Deborah Collett

Frequently asked questions

No. As long as you follow the loan terms (paying rates, insuring, maintaining the property), you can remain in your home for life.

The home is sold, the loan and interest are repaid, and remaining funds go to you or your estate.

Yes. All lenders must comply with the National Consumer Credit Protection Act (NCCP), including the No Negative Equity Guarantee.

Anything – common uses include paying off debt, covering healthcare or aged care, renovating for accessibility, or supplementing income.

Allow about $1,500 – $2,500 in total to establish your Reverse Mortgage loan. This amount includes the main costs such as the lender application fee, government charges, legal advice fees, and broker fees. This is only an estimate; you could pay more depending on the circumstances. If you are low on cash, you can usually elect to pay these Reverse Mortgage costs from the loan proceeds.

Key takeaway

A Reverse Mortgage can be a lifeline for Australians over 55 who are “asset-rich but cash-poor.” It provides flexible access to the wealth in your home while you continue living there.

But it’s not without risks: compounding interest, potential Age Pension pension impacts, and reduced inheritance are all important factors. That’s why it’s crucial to get help from a specialist Reverse Mortgage broker before making a decision.