For many Australians over 60, retirement is a time to enjoy the fruits of your labour, not worry about market crashes and investment losses. Yet with continued turbulence in both global and local share markets, more retirees are feeling the strain of unpredictable returns impacting their retirement income. If you’re one of them, there’s a powerful yet often overlooked asset that could help restore your financial confidence: your home equity.

What’s going on with the superannuation and the Australian Share Market?

In recent months, Australian and global share markets have experienced heightened volatility, driven by persistent inflation, interest rate hikes, geopolitical tension, and growing fears of a global economic slowdown. The ASX 200, while resilient long term, has been bouncing between gains and losses, enough to cause concern for self-funded retirees relying on share portfolios or superannuation investments.

Even modest drops can impact the income stream of older Australians who may not have the luxury of waiting years for a recovery.

[View here for more information on S&P/ASX 200]

Who’s Most Affected?

Retirees in the following groups are typically affected the most:

- Self-funded retirees who depend on dividends or share sales for income

- Those recently retired who locked in high exposure to equities

- Pensioners with limited cash reserves and high living costs

- Over 60s without super diversification (e.g., limited bonds or cash assets)

- People planning to retire soon, who may be forced to delay retirement or downscale their plans due to falling portfolio values

Symptoms of Financial Stress in Retirement

When the market turns, the financial and emotional effects can be serious. People affected may be experiencing:

- Anxiety about outliving your savings

- Reduced confidence in making spending decisions

- Hesitation to travel, renovate, or help family financially

- Delaying medical or health-related expenses

- A feeling of vulnerability and instability

Your Hidden Asset: Home Equity

Here’s the good news — even if your superannuation or share portfolio has taken a hit, chances are you’ve built up substantial equity in your home over the years. Unlike shares, property values tend to be more stable and don’t fluctuate dramatically day to day.

That makes home equity one of the most dependable long-term assets available to older Australians.

Recent Home Price Trends in Australia

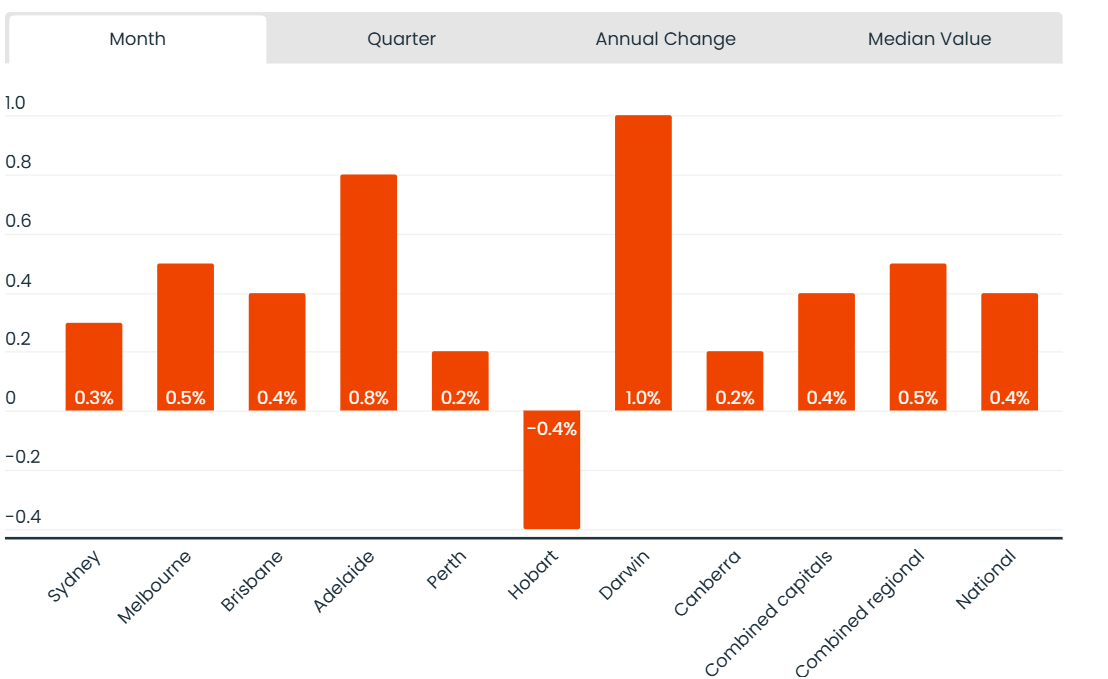

Despite the economic uncertainty, Australian home values have held up remarkably well. According to recent reports, Australian home values have recovered to new record highs in March. Values increased 0.4% over the month, the second consecutive month of growth in the national index, following a short three-month decline where values dipped 0.5%.

Shares vs Property: A Quick Comparison

| Feature | Home Equity | Share Market |

| Volatility | Low to Moderate | High |

| Liquidity | Low (without financial tools) | High |

| Income Stability | Can be accessed via reverse mortgage | Unpredictable |

| Risk | Backed by tangible asset | Subject to external shocks |

Accessing Equity: Reverse Mortgage as a Solution

For many over 60s, the equity in their home is their largest untapped asset, and with property values holding strong across much of Australia, it’s a resource that can be converted into real financial support.

One practical way to do this is through a reverse mortgage. This is a loan designed specifically for older Australians that allows you to access some of your home’s value without having to sell or move out. You remain the full owner of your property, and the loan is typically repaid when you move out or sell in the future.

Benefits of a reverse mortgage include:

• No regular repayments required

• Funds can be used for any purpose (bills, renovations, aged care, etc.)

• You stay in your home

• Offers peace of mind and financial freedom

Don’t Let Market Volatility Derail Your Retirement

If share market swings are causing you stress, it’s time to take a fresh look at your financial toolkit. Your home equity might just be the stable, untapped resource that helps ‘save’ your retirement.

With the right advice and a well-structured reverse mortgage, you can turn the value of your home into a steady, reliable source of income and support — helping you live with more confidence and less financial stress.

Want to learn more and get started?

- Book a free consultation with a licensed reverse mortgage specialist

- Download our free guide to learn more about how home equity works

Stop worrying about market crashes. Start living with confidence.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.