For many older Australians, the dream of a debt-free retirement is becoming harder to achieve. Rising property prices, longer mortgage terms, and the trend of entering the housing market later in life mean that more people are still carrying mortgage debt well into their 60s—and beyond.

According to the Colonial First State Rethinking Retirement Report (March 2025), 28% of Australians aged 50 to 64 still have a mortgage, and 14% of retirees are yet to pay theirs off. It’s a reality that’s shifting the retirement landscape, and it’s prompting critical conversations about how to manage home loan debt while living on a fixed income.

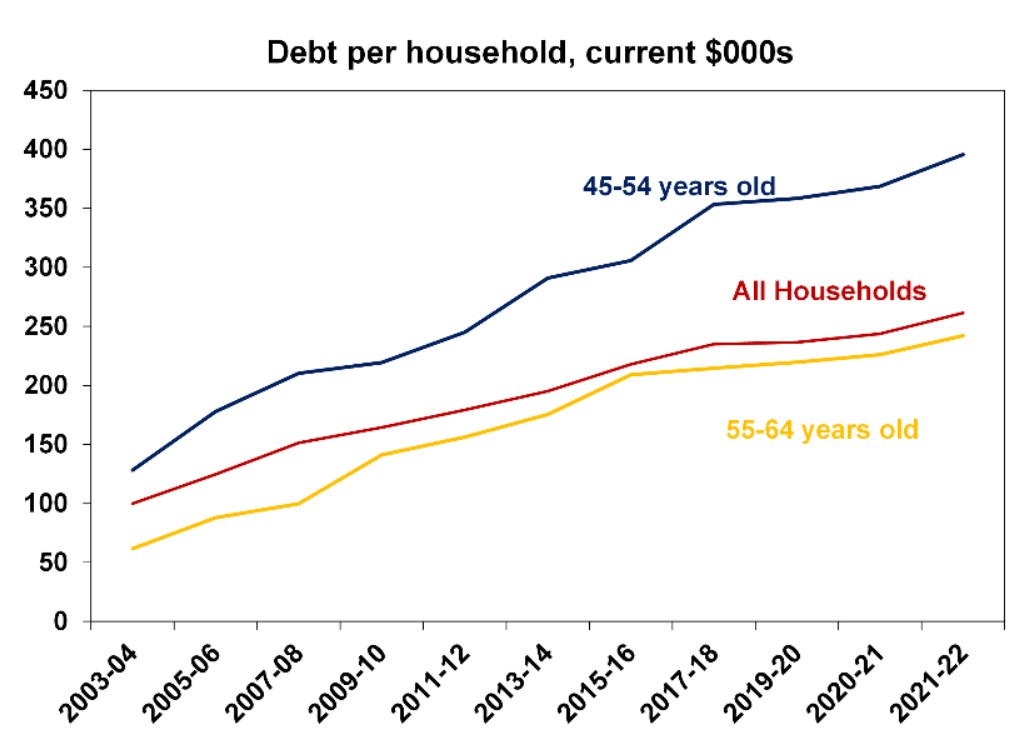

The chart from AMP below, paints the picture over the last 20 years.

While some retirees choose to delay retirement or dip into their super to reduce debt, these options aren’t always viable—or desirable. That’s where Reverse Mortgage solutions can play a key role.

Why Are So Many Australians Retiring With Debt?

There are several reasons behind this trend:

- Older first-home buyers: Many Australians are entering the property market later in life, often in their 40s or 50s, meaning their 30-year mortgages extend into retirement.

- Rising house prices: Homeownership now demands larger loans, often at higher interest rates.

- Economic pressures: The cost of living, divorce, or time off work (e.g. due to caregiving or illness) have left some with reduced financial security entering retirement.

But perhaps the most telling insight from the CFS report is that only 45% of mortgage holders approaching retirement feel confident they can retire debt-free—unless they receive financial advice. That confidence jumps to 63% with proper guidance, underlining the importance of sound retirement planning.

[ MUST READ: Are Baby Boomers to Blame for the Housing Crisis? ]

Downsizing Isn’t Popular—But Staying Comes with a Cost

Despite the debt, most Australians want to remain in their homes. Only 13% plan to downsize. The emotional value of a family home is high. It’s where memories were made, kids were raised, and connections to the community were formed.

But staying put often means continuing mortgage repayments—while managing on a lower income. Many Australians are forced to use their superannuation to cover these repayments, or worse, delay retirement altogether.

Why Not Just Use Super?

Some financial advisers suggest using superannuation to pay off a mortgage, but as CFS Technical Services Head Craig Day points out, this isn’t always the best choice.

“Using your super reduces the assets available to fund your retirement. It could result in you receiving less retirement income or your super not lasting as long.” – Craig Day, CFS

If investment returns from super are expected to be lower than your mortgage interest rate, it might make sense to withdraw a lump sum. But if returns are higher, you could be better off keeping the super invested and using a Reverse Mortgage instead.

[ ALSO READ: Reverse Mortgage vs. Super: Which is Best for paying Aged Care costs? ]

Reverse Mortgage: A Debt Solution That Lets You Stay at Home

For homeowners aged 60 and over, a Reverse Mortgage provides an alternative to selling or downsizing.

Instead of making monthly repayments, a Reverse Mortgage allows you to borrow against the equity in your home, while continuing to live in it. The loan is typically repaid when the house is sold, usually after the homeowner passes away or moves into aged care.

This makes it especially valuable for retirees who:

- Still have a mortgage but want to stop working

- Are asset-rich but cash-poor

- Want to stay in their home long term

- Need a lump sum or regular income boost to maintain their lifestyle

By using a Reverse Mortgage to pay out the remainder of their home loan, many retirees can free themselves from ongoing repayments and eliminate the stress of budgeting for debt on a fixed income.

Case Study: Heidi’s Story

Heidi, 64, from NSW, is a classic example of how a Reverse Mortgage can be life-changing.

After a divorce, Heidi was left financially vulnerable and struggling to make ends meet. Her lender agreed to pause her repayments for 3 months, but time was running out.

She feared she’d be forced to sell her home—a home she loved, in a community where she felt safe and connected.

On top of that, she was on a disability pension, and didn’t believe she could cover her future living expenses, especially with consumer debt piling up.

The Solution

Seniors First helped Heidi access a Reverse Mortgage loan facility of $247,000, structured as follows:

- $141,000 lump sum to refinance her mortgage and pay off consumer debts

- $106,000 cash reserve, undrawn but available for future needs

The Result

Heidi was able to:

- Stay in her cherished home

- Eliminate the stress of monthly repayments

- Use her cash reserve to supplement her income for 8–10 years

- Pay for much-needed dental work, home repairs, and a new car

Heidi didn’t just escape financial hardship—she improved her quality of life and entered retirement with dignity and peace of mind.

Want to learn more about Reverse Mortgage? Find out more about how to use a Reverse Mortgage for debt consolidation or download your FREE Reverse Mortgage GUIDE.

Ready to Apply? You can now check your eligibility online or call Seniors First on 1300 745 745.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.