As the cost of living continues to rise in Australia, many seniors find themselves struggling to meet monthly mortgage repayments. For retirees on fixed incomes, juggling financial obligations with everyday expenses can feel like an insurmountable challenge.

However, there’s a solution that offers relief: a Reverse Mortgage. This financial product, particularly through Seniors First, enables older Australians to refinance their mortgage and enjoy the unique benefit of no monthly repayments.

This blog explores the financial strain many seniors face, how a Reverse Mortgage works, and why it’s an effective tool to provide breathing room and long-term security.

The Growing Mortgage Burden for Australian Seniors

The dream of living mortgage-free in retirement is becoming less achievable for many Australians. A combination of factors, including rising property prices, later-life borrowing, and extended loan terms, has left many retirees carrying mortgage debt well into their golden years.

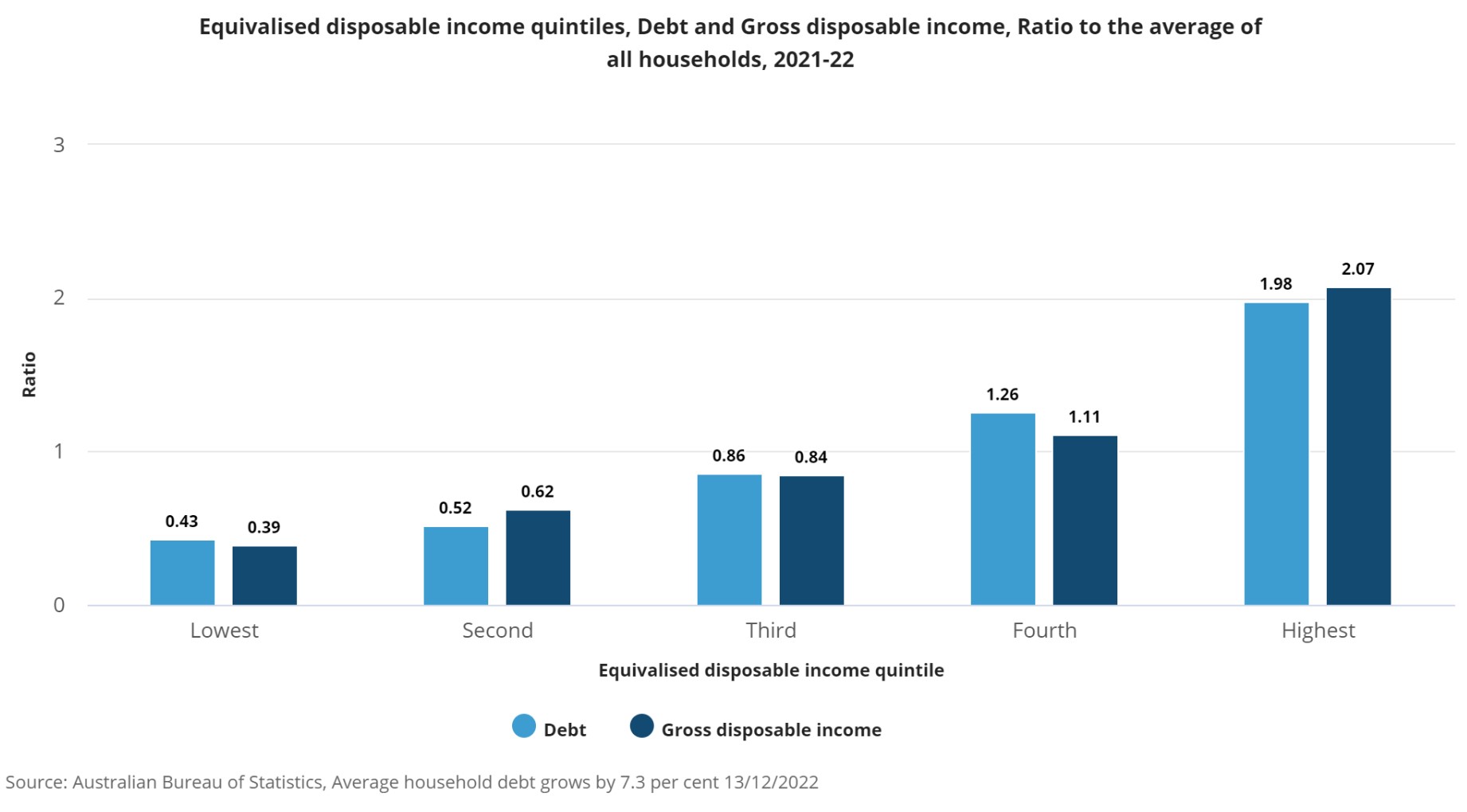

Recent research, including a pivotal study from AMP and critical data from the Australian Bureau of Statistics, paints a clear picture: the level of mortgage debt among Australians over 50 is at an all-time high.

Imagine, two decades ago, the average household debt for those aged over 55 was a mere fraction of what it is today. Now, it’s not uncommon to retire with a significant mortgage still hanging over your head.

Financial Strain on Fixed Incomes

For seniors who rely primarily on the Age Pension or limited superannuation savings, servicing a mortgage can be particularly burdensome. Monthly repayments often consume a significant portion of their income, leaving little room for essentials like groceries, utilities, and healthcare.

Emotional and Physical Toll

The stress of meeting mortgage obligations doesn’t just impact finances—it can also take a toll on mental and physical health. The constant worry about making ends meet can lead to anxiety, sleepless nights, and even physical ailments, further diminishing quality of life.

[ RELATED POST: Reverse Mortgage Case Study: How Vince Saved His Home and Regained Financial Freedom ]

How a Reverse Mortgage Can Help

A Reverse Mortgage provides a lifeline for seniors burdened by mortgage repayments. It allows homeowners aged 55 and older to access a portion of their home’s equity without the need to sell or move out. The most significant advantage? No monthly repayments are required.

Refinancing Your Existing Mortgage

One of the most common uses of a Reverse Mortgage is to refinance an existing home loan. By doing so, seniors can eliminate the stress of monthly repayments while still retaining ownership of their property. Here’s how it works:

- Pay Off Your Mortgage

The Reverse Mortgage funds are used to clear your existing mortgage balance. This removes the immediate pressure of making regular repayments. - No Monthly Repayments

Unlike traditional refinancing options, a Reverse Mortgage doesn’t require monthly repayments. The loan balance, including accrued interest, is repaid when you sell your home, move into aged care, or pass away. - Retain Ownership

You remain the owner of your home, with full rights to live in it as long as you choose, provided you meet basic loan obligations like maintaining the property and paying insurance.

Flexible Fund Access

With a Reverse Mortgage, you can choose how you receive your funds. Whether you need a lump sum to pay off your existing mortgage, a line of credit for future expenses, or regular payments to supplement your income, the choice is yours.

[ RELATED POST: Can You Pay Out A Home Loan By Refinancing With a Reverse Mortgage? ]

Benefits of a Reverse Mortgage

For seniors facing mortgage stress, a Reverse Mortgage offers numerous advantages that go beyond immediate financial relief.

1. No Monthly Repayments

The standout benefit is the elimination of monthly repayments. This feature allows seniors to redirect their limited income toward daily living expenses and enjoy a more comfortable retirement without the constant worry of mortgage obligations.

2. Improved Cash Flow

By refinancing with a Reverse Mortgage, you can free up your income for other priorities, such as healthcare, leisure activities, or even helping family members. The additional financial flexibility can significantly enhance your quality of life.

3. Stay in Your Home

Many seniors fear losing their homes due to financial difficulties. A Reverse Mortgage allows you to age in place, surrounded by familiar surroundings, neighbors, and memories, while still addressing your financial needs.

4. Debt Consolidation

If you have other debts in addition to your mortgage, a Reverse Mortgage can be used to consolidate these obligations, simplifying your finances and reducing stress.

5. No Risk of Owing More Than Your Home’s Value

Seniors First Reverse Mortgages include a No Negative Equity Guarantee, ensuring that you or your estate will never owe more than the value of your home, even if the loan balance exceeds the property’s sale price.

Is a Reverse Mortgage Right for You?

A Reverse Mortgage isn’t for everyone, but it’s an excellent option for seniors who:

- Struggle with mortgage repayments and need immediate relief.

- Want to remain in their homes while improving their financial situation.

- Value flexibility in accessing funds for various needs.

- Seek a solution that doesn’t require selling their home or moving out.

Want to learn more about Reverse Mortgage? Download your FREE Reverse Mortgage GUIDE.

Ready to Apply? You can now check your eligibility online or call Seniors First on 1300 745 745.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.