When it comes to reverse mortgages, you might imagine retirees have plenty of time to wait. But new research from Seniors First tells a very different story.

Our latest customer survey found that speed to funding — how quickly the money becomes available after applying — is now one of the most important factors for Australian seniors.

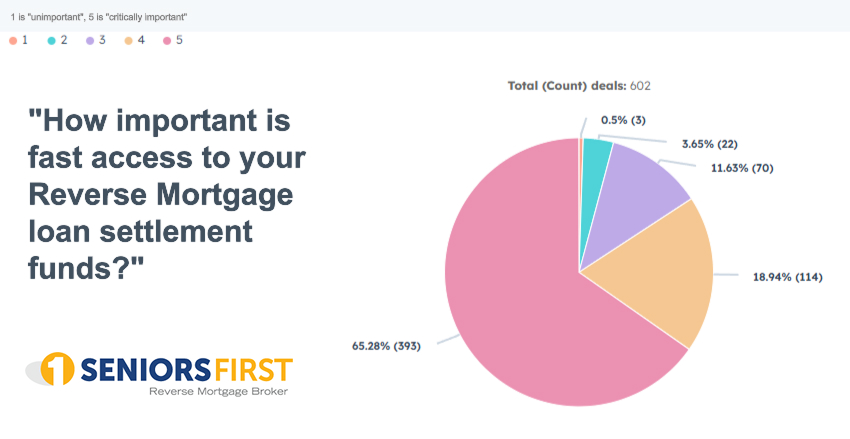

In fact, 65% of borrowers said fast access to funds was “critical”, while another 19% said it was “very important.” That means more than four in five borrowers place a high value on getting their loan settled quickly.

Why the Rush?

According to Darren Moffatt, Founder and Managing Director of Seniors First, this finding challenges the common stereotype that retirees are never in a hurry.

“Many people assume older Australians take their time with big decisions,” Darren said. “But what we’re seeing is the opposite. A lot of clients leave their application until the last minute, or they’re feeling the strain from cost-of-living pressures and need access to funds sooner rather than later.”

More and more seniors are using reverse mortgages to cover urgent expenses, such as medical bills, home repairs, or increased day-to-day living costs. For those customers, a few extra weeks can make a big difference.

How Long Does Reverse Mortgage Funding Usually Take?

The typical funding cycle for a reverse mortgage in Australia is between 5 to 10 weeks from application to settlement, depending on the lender’s processes and requirements.

At Seniors First, however, our team often helps clients receive their funds much faster — sometimes in as little as three to four weeks, and in urgent cases, as quickly as two weeks.

How Seniors First Achieves Faster Outcomes

One of the key benefits of using a specialist reverse mortgage broker like Seniors First is our deep understanding of lender service standards. We know exactly which lenders can turn applications around the fastest at any given time.

Because of our long-standing relationships with leading lenders, we can often expedite urgent cases and make sure applications are prioritised when time is critical.

We’ve also invested heavily in technology and automation, creating one of the most streamlined processes in the market. Our systems help reduce paperwork, eliminate bottlenecks, and keep applications moving efficiently through every stage of approval.

“Our focus has always been on helping older Australians access their home equity safely — but also efficiently,” Darren said. “When someone needs funds to relieve financial pressure, they shouldn’t have to wait any longer than necessary.”

The Bottom Line

These survey results make one thing clear: Australian seniors are becoming more proactive — and more impatient — when it comes to unlocking their home equity.

With living costs still rising, fast access to funds isn’t just convenient; it’s essential for financial peace of mind.

If you’re considering a reverse mortgage and want to understand which lender can fund your loan the fastest, our experienced brokers can help you compare options and guide you every step of the way.

Talk to a Specialist Today

To learn more or get started, call Seniors First on 1300 745 745, or enquire online here.