For older Australians living on pension, maintaining a modest life could be a challenge. Your income in your retirement years will not be enough to pay for all your needs, so you might resort to cost-cutting and even debt just to make ends meet.

Chances are, you have accumulated your wealth in form of home equity once you have fully paid your mortgage. But with reduced income, you might end up assets rich, yet cash poor.

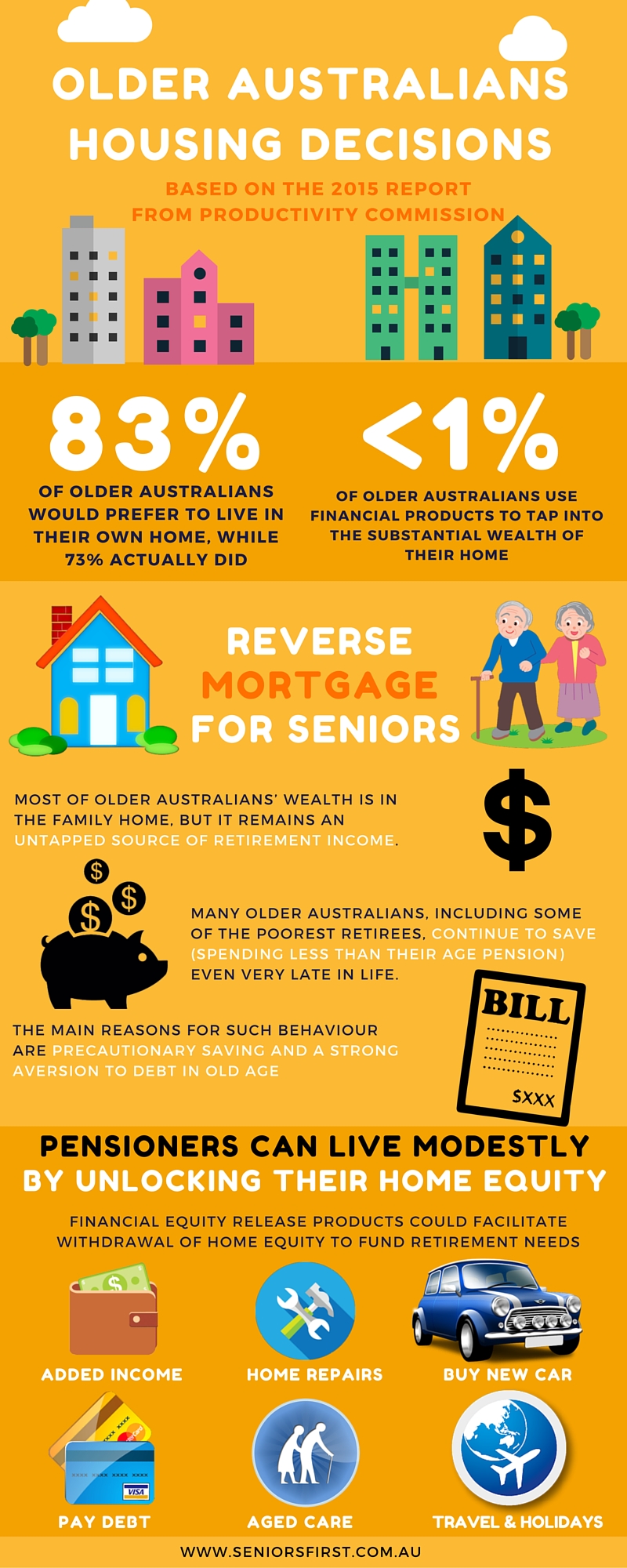

In December 2015, the Productivity Commission released a report that shows 83% of older Australians prefer to live in their own home while 73 per cent actually did. However, less than 1% of older Australians use financial products to tap into the substantial wealth of their home.

Check out the infographic above from Seniors First Finance to learn why older Australians are still not tapping financial products and how a reverse mortgage loan can help you pay for your retirement needs.

[…] (Related Article: Housing Decisions of Older Australians [Infographic]) […]