Recently, I appeared on national television to talk about Reverse Mortgages — what they are, who they’re for, and how they can help older Australians access the wealth tied up in their homes.

If you saw the segment on Channel 9 news, you’ll know it was a positive and balanced discussion. Television is a powerful platform, and I’m genuinely pleased it helped raise awareness that Reverse Mortgages today are very different from what many people remember — highly regulated, consumer-protected, and increasingly common as part of retirement planning.

But what viewers don’t always realise is that TV segments are tightly time-limited. For every minute that makes it to air, there are often many more minutes of conversation that don’t.

And in this case, some of the most important educational points were left out — not because they weren’t important, but because there simply wasn’t time.

This blog is my opportunity to share what didn’t make it to air, and why it matters so much if you’re considering a Reverse Mortgage.

Awareness Is Important — But Education Is Where Outcomes Are Won or Lost

The TV segment did a good job explaining what a Reverse Mortgage is. That matters. Many Australians over 60 still assume Reverse Mortgages are unsafe, unregulated, or something to avoid entirely.

“Reverse Mortgages today are nothing like what many Australians remember — they’re regulated, transparent, and designed to help people stay in their homes longer.”

The reality today is very different. Modern Reverse Mortgages come with strong consumer protections, including the No Negative Equity Guarantee, meaning you’ll never owe more than the value of your home.

But understanding the definition is only the beginning.

What truly determines whether a Reverse Mortgage works for you — or quietly works against you — is how it’s structured and used over time. That level of nuance is very difficult to convey in a short TV segment, but it’s exactly where good advice makes the biggest difference.

The Reverse Mortgage “Golden Rule”

One concept I spoke about during the interview — but which didn’t make it to air — is what I call the Reverse Mortgage Golden Rule:

Draw as much of the loan funds as possible, gradually over time (rather than as a lump sum upfront)

Not following this rule is the most common mistake made by borrowers who don’t use a specialist broker.

Lenders calculate a maximum amount you can access based on your age and property value. But that figure has nothing to do with what’s sensible for your retirement, your cash-flow needs, or your long-term plans.

“Just because a lender says you can borrow a certain amount doesn’t mean it’s the right amount for your retirement.”

Borrowing too much, too early, can cause the loan balance to grow far faster than necessary due to compounding interest.

A Reverse Mortgage works best when it’s used strategically, not maximised by default — and that distinction is rarely made clear without specialist guidance.

How Smart Loan Structure Can Save Huge Interest Over Time

Another critical topic that didn’t make it to air was loan structure — and how much difference it can make to the total interest paid over the life of a Reverse Mortgage.

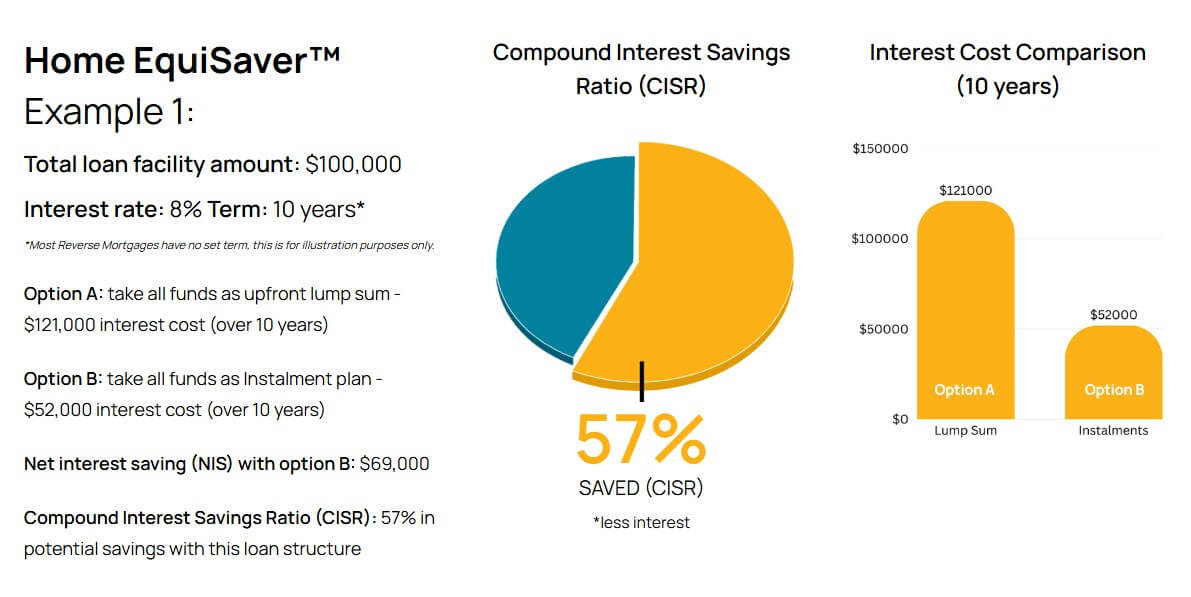

At Seniors First, we often talk about what we call the Home Equisaver™ approach. It’s not a product — it’s a way of structuring a loan that prioritises flexibility and interest control.

Rather than taking a large lump sum upfront, many retirees are better served by:

- Drawing only what they need, when they need it

- Keeping the remaining funds available but undrawn

- Using reserves or future drawdowns strategically

Why does this matter?

Because interest is only charged on money you’ve actually drawn. Funds left untouched don’t accrue interest. Over time, that difference can amount to tens — even hundreds — of thousands of dollars.

“With Reverse Mortgages, interest only grows on the money you actually use — structure alone can change outcomes by hundreds of thousands of dollars.”

This is where specialist advice becomes crucial. Most lenders won’t explain these strategies in depth. Some brokers don’t either. But structure is not a detail — it’s the difference between a loan that quietly erodes equity and one that supports retirement with control and confidence.

‘The New Epidemic’: Retiring With Debt

Another part of the conversation that didn’t make it to air was what I often describe as a new retirement reality — more Australians entering retirement with debt.

This isn’t about reckless spending. It’s about:

- Longer working lives

- Later mortgages

- Helping adult children

- Rising living costs

- Lower real income growth in retirement

Many people today reach their 60s and 70s owning valuable homes but living on limited, fixed incomes — often with outstanding debts that place real pressure on cash flow.

“More Australians are reaching retirement with valuable homes but very tight cash flow — pretending that problem doesn’t exist doesn’t help anyone.”

For these Australians, selling the family home isn’t always desirable or necessary. But doing nothing can also come at a cost.

Reverse Mortgages, when used properly, can help manage this transition — but only when they’re approached carefully, conservatively, and with the right advice.

Why Using a Specialist Broker Really Matters

This is the part that never fits neatly into a TV segment, but is arguably the most important message of all.

Reverse Mortgages are not standard home loans. They sit at the intersection of lending, retirement planning, regulation, and long-term personal outcomes.

A specialist broker:

- Understands how interest compounds over decades, not years

- Structures loans to limit unnecessary drawdowns

- Explains risks and safeguards in plain English

- Compares policies across lenders — not just rates

- Acts as an advocate for the borrower, not the bank

Most importantly, a specialist broker knows when a Reverse Mortgage isn’t the right solution — and is willing to say so.

“A Reverse Mortgage isn’t just a loan — it’s a long-term retirement decision, and it needs specialist advice, not a generic solution.”

This is not a product you should ever take out online, through a call centre, or without deep explanation. The decisions you make upfront can shape your financial flexibility for the rest of your life.

TV Can Start the Conversation — The Right Advice Finishes It

I’m proud of the TV segment. It helped normalise an important conversation and reached people who may never have considered their options before.

But television can only raise awareness. It can’t tailor advice. It can’t explain structure. And it can’t walk beside you as your circumstances change over time.

“When used carefully and conservatively, a Reverse Mortgage can protect retirement — but the structure you choose at the start matters for the rest of your life.”

That’s where specialist, client-first guidance comes in.

If watching the segment prompted you to ask questions, challenge assumptions, or simply want to understand your options better — that’s a good place to start.

The next step is making sure you’re informed, protected, and supported by people who do this work every day, for Australians just like you.

Final Thought

Reverse Mortgages are neither something to fear nor something to rush into. They are a tool — and like any tool, their value depends entirely on how they’re used.

My role, and the role of Seniors First, has always been to ensure older Australians understand not just what’s possible — but what’s sensible.

If you’re considering a Reverse Mortgage, take the time to get specialist advice. It can make a meaningful difference to your retirement — not just today, but for years to come.