For many Australians over 55, home ownership brings both comfort and challenge. You’ve likely built up significant equity in your home but rising living costs, credit card debt, or lingering home loans can make cash flow tight.

The good news? You don’t always have to sell your home to get back on top. There are three main ways to unlock your home’s value to pay out loans, or to consolidate debt:

- Downsizing real estate

- The Home Equity Access Scheme (HEAS)

- A Reverse Mortgage

Each option has its own pros, cons, and ideal situations. Let’s look at how they compare — and which one might be the best fit for you.

Downsizing to clear mortgage debt: selling and starting Fresh

If you’re open to a big lifestyle change, downsizing can be an effective way to clear debts completely.

Pros

- You can free up a large lump sum by selling your home and buying a smaller, cheaper property.

- It’s a non-loan solution meaning no ongoing interest or repayments.

- You might qualify for the Downsizer Super Contribution, which lets you put up to $300,000 per person from the sale into your super.

Cons

- Moving can be emotionally and physically stressful, especially if you’ve lived in your home for decades.

- Costs add up agent commissions, stamp duty, and relocation expenses can eat into your proceeds.

- Having extra cash on hand may affect your Age Pension eligibility, since the money becomes assessable under Centrelink rules.

Best For

Seniors who are ready for a fresh start and want to clear all debts at once — even if it means letting go of their current home.

[ ALSO READ: Reverse Mortgage or Downsizing: Which Option is Best for Your Retirement? ]

The Home Equity Access Scheme (HEAS): A Government-Backed Loan

The Home Equity Access Scheme run by Centrelink and the Department of Veterans’ Affairs lets eligible Australians use some of their home equity to top up their income through regular payments.

Pros

- Great for paying down small debts like credit cards or personal loans.

- Comes with government backing and a relatively low interest rate.

- You can choose regular fortnightly payments rather than a lump sum, which helps with budgeting.

Cons

- Very limited lump sum access is not enough for larger debt consolidation.

- The total amount you can borrow is capped (usually 1.5× the maximum pension rate).

- Only available to Age Pensioners or self-funded retirees aged 67+.

- The loan balance grows over time with compound interest.

Best For

Pensioners who need a small, safe income boost to manage minor debts or everyday expenses, without taking on a large loan.

[ ALSO READ: ‘Government Reverse Mortgage’ booms in 2024: Why Home Equity Access Scheme (HEAS) is so popular ]

Reverse Mortgage: The Best Option Home Loan Refinance

If you’re 55 or older and want to stay in your home while clearing larger debts, a Reverse Mortgage Australia can offer the most flexibility and access to funds.

Pros

- Provides the largest loan amounts without selling your home.

- Funds are tax-free and can be used to refinance home loans, pay off credit cards, or fund renovations.

- No monthly repayments are required; the loan is repaid when you sell, move out, or pass away.

- You’re protected by the No Negative Equity Guarantee, which means you’ll never owe more than your home’s value.

Cons

- Interest compounds over time, increasing the total amount owed.

- Can reduce the inheritance available for your beneficiaries.

- Depending on how funds are used, it may slightly affect pension eligibility.

- Setup fees and interest rates are typically higher than the HEAS.

Best For

Over-55s with substantial home equity who want to stay put, refinance a home loan, consolidate debt, and improve cash flow without selling their property.

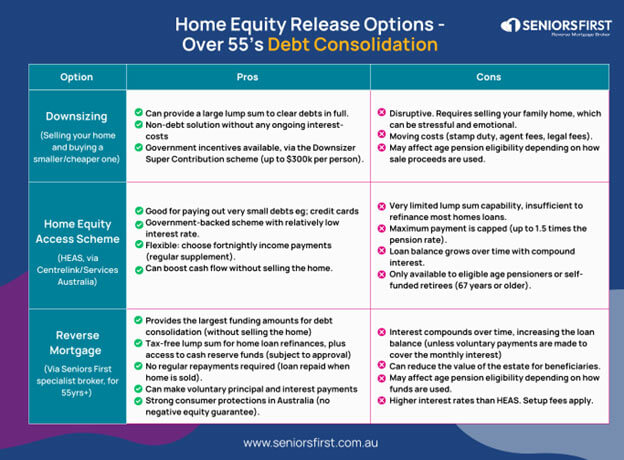

Home Equity Release for Debt Consolidation: A Comparison

To help you compare your options at a glance, here’s a quick side-by-side look at how Downsizing, the Home Equity Access Scheme (HEAS), and a Reverse Mortgage stack up for over-55s considering debt consolidation.

How to Choose What’s Right for You

Every household’s situation is different, but here are some questions to help you decide:

- Do I want to stay in my home, or am I open to moving?

- How large is the debt I’m trying to consolidate?

- Am I eligible for government programs like the HEAS or Downsizer Super Contribution?

- How will each option affect my Age Pension and long-term financial security?

- Have I spoken to a specialist Reverse Mortgage broker or financial adviser for projections and independent advice?

The Bottom Line

Debt consolidation after 55 doesn’t have to be stressful. Whether it’s downsizing for a clean slate, tapping into the government’s HEAS for a small top-up, or using a Reverse Mortgage to manage larger debts — there’s a path to financial freedom that fits your needs and lifestyle.

The key is to get the right advice before you decide.

Talk to a Reverse Mortgage Broker

If you’re exploring debt consolidation and want to understand your options, Seniors First can help.

Contact Seniors First today for a free, no-obligation chat.

Our specialist brokers can help you compare Downsizing, HEAS, and Reverse Mortgage options — and find the one that works best for your retirement goals.

Want to learn more about Reverse Mortgage? Find out more about how to use a Reverse Mortgage or download your FREE REVERSE MORTGAGE GUIDE.

Ready to Apply? You can now check your eligibility online or call Seniors First on 1300 745 745.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before you make any decision.