How to Spot – and Stop – Elder Abuse

At least one in six older Australians experienced a form of elderly abuse, and most of the perpetrators are their children, according to a landmark study released before Christmas by the Australian Institute of Family Studies (AIFS).

The Attorney-General’s Department commissioned the National Elder Abuse Prevalence Study conducted by AIFS to identify the definitive facts on the prevalence of elder abuse in Australia.

The final report was submitted to the federal government in Autumn but was publicly released several days before Christmas.

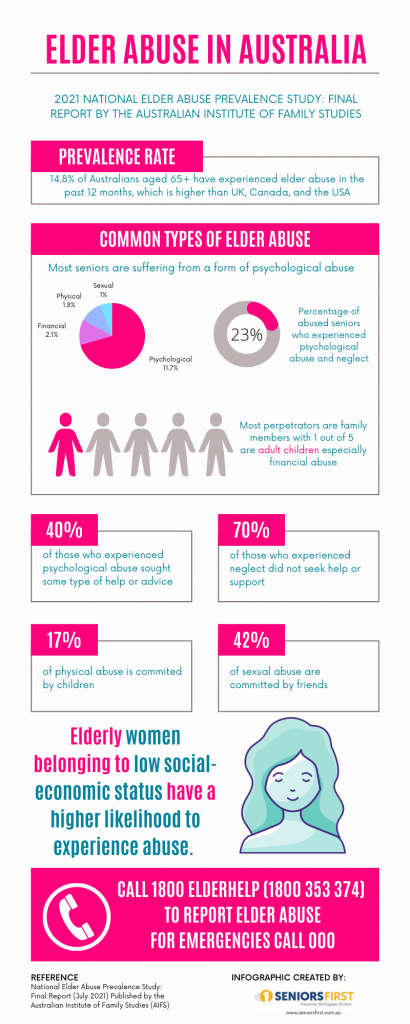

It reveals that the national prevalence of elderly abuse in Australia is 14.8%, meaning 1 in 6 seniors suffered abuse of some form such as psychological, physical, financial, sexual abuse, and neglect.

The most common form of elder abuse was psychological abuse, experienced by 11.7 per cent of older people.

AIFS deputy director of research Dr. Rae Kaspiew said this was not always recognised by victims or perpetrators, so it was measured through questions about whether the person had been insulted, excluded, repeatedly ignored, undermined, belittled, or threatened including threats to harm someone else.

The Australian figure is slightly lower than the global prevalence rate (15.7%) but significantly higher than the UK (2.6%), Canada (8.2%), and the USA (7.6%).

It was also noted that prevalence rates are slightly higher for women than for men.

Moreover, study authors said the true rate of elder abuse in Australia could be higher because the report only included seniors living in the community with capacity to consent, excluding people living in aged care or are suffering from cognitive decline.

At least 7,000 Australians over the age of 65 were surveyed about their experiences in the past 12 months. The report also included a separate survey of 3,400 Australians aged 18 to 64.

Financial Abuse: Third Most Common Type of Elderly Abuse in Australia

The report also looked into the abuses experienced by Australian seniors in relation to finances, and found out that the most common form of financial abuse was being ‘pressured into giving or loaning money, possessions or property.”

Other forms of financial abuse cited in the report included:

- Taking money, possessions, or property without permission

- Not contributing to household expenses such as rent, food or aged care / home service fees where it was previously agreed

- Deliberately preventing the access or use of money, possessions, or property

- Pressuring to make or change a will

- Making financial decisions without permission

- Doing anything else to harm the elderly financially

CASE STUDY:

Catherine is a widow who lives in her lovely home in Sydney worth $780,000. Her eldest son, Jacob, has been unemployed for three years, and lost thousands of money due to gambling. Catherine invited Jacob to move back into her home but they agreed that he will find a job and contribute to household expenses. But six months has passed Jacob was still not able to land a job so Catherine’s household expenses significantly increased. One day, Jacob learned about reverse mortgage loans and tried persuading his mother to take the loan “because he needs the money to bounce back.” But Catherine was sure her son would just burn the money on the casino. She declined but later she learned that Jacob forged her signature and the house was put on reverse mortgage.

DID YOU KNOW: A Seniors First reverse mortgage can help elderly Australians unlock their home equity so they can have access to cash for their important needs such as aged care, medical expenses, home renovation, or even a holiday.

To safeguard against possible financial abuse, our representatives will conduct a detailed interview with the borrower to gather information and recommend if the loan is right for you. We also sit in with family members and recommend independent legal advice before proceeding with the loan application.

What are the Signs of Elder Abuse?

The AIFS study found out that perpetrators were mostly family members with adult children the most likely to commit abuse, making up almost 20%.

Friends (12%), neighbours (7%) and acquaintances (9%) were also mentioned as commonly responsible.

Dr. Kaspiew said the findings reveal a concerning problem in Australia.

“The fact that it’s often the people closest to them who are committing the abuse is particularly concerning, as this can create a desire by the victim to keep the abuse a secret to avoid shame, embarrassment and negative repercussions for the perpetrator – especially when it comes to family members,” said Dr. Kaspiew.

So it is crucial for the people who are in contact with seniors to spot the telltale signs of abuse.

To encourage people to open their eyes and identify the signs of elderly abuse, the Australian Human Rights Commission published the “Know the Signs” video:

How to Stop Elderly Abuse

The study cited the most frequent action taken by people to stop the abuse involves the victim speaking directly to the perpetrator and breaking contact with or avoiding the perpetrator.

However, the study authors warn these actions may make the impact of the abuse worse, by increasing the older person’s isolation.

“Breaking contact with or avoiding the perpetrator may serve to further exacerbate the effects of the abuse on the older person because of their social withdrawal.

“Family dynamics can make abuse difficult to address. For example, when the abuse is perpetrated by an adult child, the older person may be reluctant to expose the abuse to avoid losing contact with other family members such as grandchildren,” said Dr. Kaspiew.

Report Elder Abuse

A better way to stop elder abuse is to report it to proper government authorities to access proper support in dealing with the situation.

If you are concerned about elder abuse you may want information, or the opportunity to talk to someone about your concerns, and options for getting help.

1800 ELDERHelp (1800 353 374) is the National Elder Abuse phone line. 1800ELDERHelp automatically redirects callers seeking information or advice on elder abuse to their state or territory phone line service. If you require assistance in an emergency or life-threatening situation, contact 000.

My mother was diagnosed incapable of handling her affairs … requiring nurses home and Administration Order .. frontal lobe dementia .. by a Psychogeriatrician Neuropsychologist and Geriatrician … she went to a Guardianship Board meeting for Administration Order but … her lawyer took her to the meeting … she asked for a Power of Attorney .. with the lawyer … the meeting was adjourned .. a EPOA was executed and returned to the Board…. the Board then dismissed the Administration Order on the grounds a EPOA was executed and was responsible for her Estate

Twelve years later ..she died aged 95. No records were ever kept .. little left in Estate .. sold valuable freehold rented properties years before her death .. property unaccounted for missing believed stolen … War Medals sold

The lawyer is from very prominent Legal family.

I went to LPCC … he made a Determination on the Legal Practitioners Act found Lawyer did nothing wrong and closed the case

I can’t get any Legal help! This is SA .. there is no Department governing the Act … no Department has jurisdiction on the LPCC. I could not appeal because it was his decision .. and he was the Commissioner!

My mother had a healthy Estate. She had a Will .. what little was left did get shared.. no records..The lawyer became Co-Executor .. with no JEPOA records .. I am told this is a conflict of interest

Please can you advise.