As Australia steps into a new era marked by an ever-evolving demographic landscape, the 2023 Intergenerational Report sheds light on a crucial aspect of our nation’s future: the ageing of our population. The report shows Australians are currently living longer with more years in full health and more time using government-funded services.

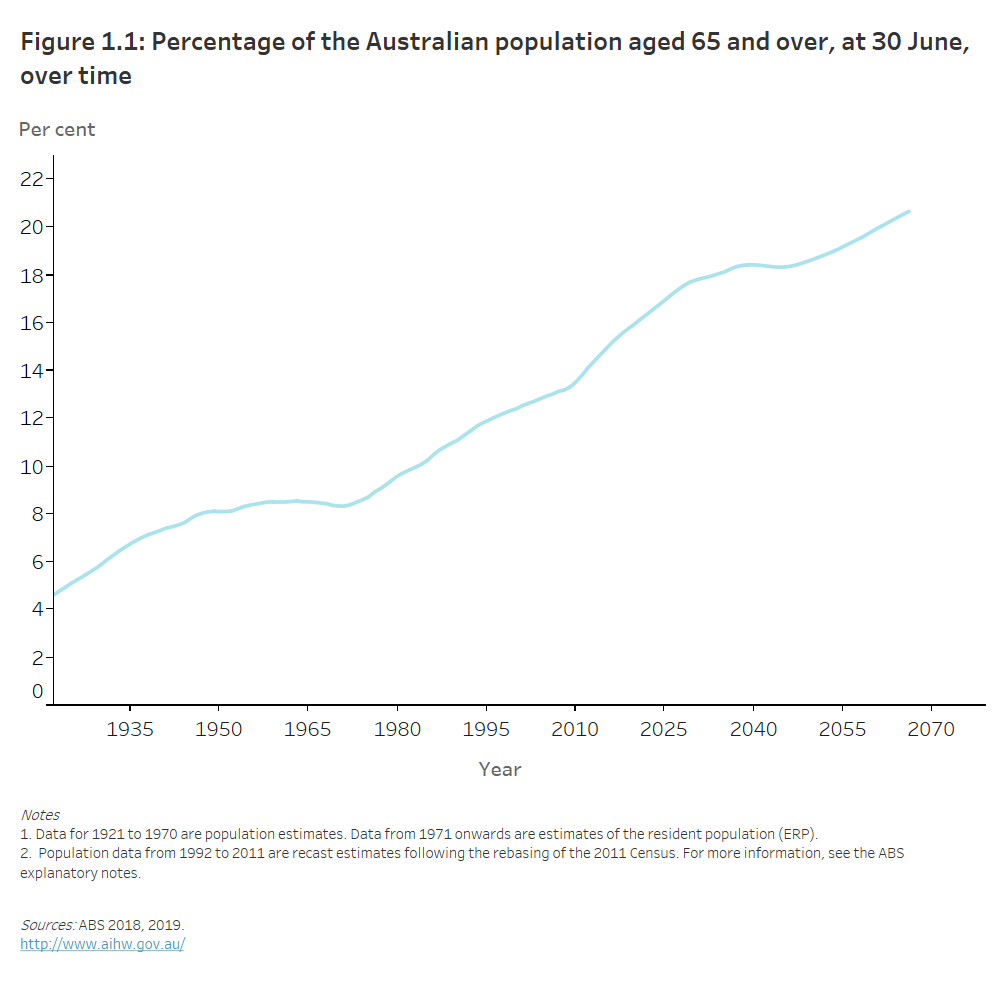

Meanwhile, the Australian Institute of Health and Welfare (AIHW) reports that the number and percentage of older Australians is expected to continue to grow. By year 2066, it is projected that older people in Australia will make up between 21% and 23% of the total population.

These insights are not just statistics; it’s about you, your neighbours, and your community transitioning into retirement.

With this change comes the challenge of ensuring that your hard-earned nest egg stretches far enough to provide a comfortable and secure retirement.

But what if there’s untapped potential in your most significant asset – your home? Here’s where a concept that’s gaining attention comes into play: Reverse Mortgages.

The Role of Home Equity in Retirement Planning

Your home, the place where you’ve created countless memories, is more than just a roof over your head. It’s a significant financial asset, often the most substantial one in Australian households.

For many pensioners, their home constitutes a substantial portion of their net wealth. The Treasury’s Retirement Income Review positions Australia as a global leader in integrating home equity as a key element of retirement funding. Accordingly, the federal government has established clear guidelines to help retirees bolster their self-funded retirement, supplementing government benefits and superannuation with their considerable home equity, which amounts to about $1 trillion.

Now, you might be weighing up options like downsizing to a smaller home to free up some cash. It’s a common route, but it comes with its own set of challenges, both emotional and financial. There’s the stress of moving, leaving behind a community you love, and the costs involved in the sale and purchase of a new property.

Enter Reverse Mortgages, a tool that lets you access the wealth tied up in your home while continuing to live there. Unlike downsizing, a Reverse Mortgage allows you to stay in your familiar surroundings, maintain your social connections, and still benefit from the financial boost you need.

[ Related: Reverse Mortgage or Downsizing: Which Option is Best for Your Retirement? ]

How Reverse Mortgages Work

One of the most appealing features of Reverse Mortgages is the no monthly repayment aspect. Unlike traditional mortgages, with a Reverse Mortgage, you don’t have to worry about monthly repayments. This means more breathing room in your budget, and less financial stress.

But how and when do you repay the loan? The repayment of a Reverse Mortgage is unique. It’s typically not due until you decide to sell your home, move into aged care, or upon your passing. This feature allows you to benefit from the equity in your home without the immediate burden of repayment schedules.

Now, let’s address some common concerns and misconceptions:

- Will I lose ownership of my home? Absolutely not. You retain the title and ownership of your home throughout the duration of the Reverse Mortgage. It’s about leveraging your asset, not losing it.

- Will I owe more than my home’s worth? Here’s some good news – many Reverse Mortgages come with a ‘no negative equity guarantee’. This means you (or your estate) won’t have to pay back more than the sale price of the home, even if the loan amount exceeds it.

- Can I leave my home to my children? Yes, you can. Your home remains your asset. However, the loan will need to be repaid from your estate or the sale of the home. It’s a good idea to discuss these details with your family and financial advisor to ensure everyone’s on the same page.

- What about interest rates? The interest on a Reverse Mortgage is typically higher than a standard home loan but is compounded onto the loan balance over time. It’s crucial to understand the long-term impact of this on your equity.

Understanding these aspects of a Reverse Mortgage can help you make an informed decision about whether this financial solution aligns with your retirement goals.

[ Related: Reverse Mortgage Interest Rates: Facts & Trends You Need To Know ]

Aligning Reverse Mortgages with Seniors’ Needs

Firstly, a Reverse Mortgage can be a steady source to supplement your retirement income. Whether it’s to cover day-to-day expenses, enjoy a few luxuries, or even go on that dream holiday, a Reverse Mortgage gives you the financial freedom to do so. By unlocking the equity in your home, you gain access to funds that can make your retirement not just comfortable, but enjoyable.

But what about aged care? As you age, your needs might change, and aged care might become a part of your life. Aged care services, whether in-home or residential, can be quite expensive. A Reverse Mortgage can be a practical solution to fund these services. It ensures that you can afford quality care without having to sell your home or dip into your savings significantly.

It’s crucial to understand that a Reverse Mortgage isn’t a one-size-fits-all solution. Your situation is unique, and so are your needs. That’s why it’s important to consider how a Reverse Mortgage fits into your overall retirement plan. Think about your current financial situation, your future needs, and how you envision your retirement years.

Get Personalised Reverse Mortgage Help

As you ponder your retirement plans, consider how a Reverse Mortgage could fit into your financial strategy. It’s a decision that deserves careful thought and personalised assistance.

And that’s where Seniors First can assist. We’re here to guide you through the intricacies of Reverse Mortgages, answer your questions, and help tailor a solution that’s right for you.

If you’re curious to learn more or ready to take the next step, don’t hesitate to reach out.

Contact Seniors First to arrange a meeting with one of our accredited brokers.

W